Pay stubs are an essential part of any employee’s financial record. They provide a detailed breakdown of an individual’s earnings, deductions, and net pay for a specific pay period.

Pay stubs serve as a crucial record of compensation for personal budgeting, employment verification, and dispute resolution. Employers use pay stubs to maintain transparency, ensure compliance with wage laws, and create an audit trail for tax purposes.

What Is A Pay Stub?

A pay stub, also known as a paycheck stub, pay advice, or earnings statement, is a document provided by an employer to an employee along with their paycheck. It outlines the details of the employee’s earnings and deductions for a specific pay period.

Pay stubs typically include information such as gross wages, taxes withheld, deductions for benefits, and net pay.

What Are Pay Stubs Used For?

Pay stubs serve multiple purposes for both employees and employers. For employees, pay stubs are a valuable tool for understanding their total compensation, tracking earnings over time, and ensuring accuracy in payroll. They also provide proof of income for loans, rental applications, and other financial transactions.

Employers use pay stubs to maintain accurate records, verify employment and salary information, and comply with wage laws and regulations.

Employee Benefits of Pay Stubs

For employees, pay stubs offer several key benefits:

- Transparency: Pay stubs provide a clear breakdown of how an employee’s pay is calculated

- Budgeting: Employees can use pay stubs to track their earnings and expenses for better financial planning

- Proof of Income: Pay stubs serve as official documentation of income for loans, leases, and other financial transactions

Employer Benefits of Pay Stubs

Employers also benefit from using pay stubs in several ways:

- Record Keeping: Pay stubs help employers maintain accurate records of employee compensation

- Compliance: Pay stubs ensure that employers comply with wage laws and regulations

- Dispute Resolution: Pay stubs provide a clear audit trail for resolving any disputes over wages or deductions

Why Are Pay Stubs Important?

Pay stubs are important for several reasons.

Transparency and Trust

By providing employees with detailed pay stubs, employers demonstrate transparency in their payroll practices. This transparency fosters trust and confidence among employees, as they can see exactly how their pay is calculated and understand any deductions made. Clear and accurate pay stubs contribute to a positive work environment and can help prevent misunderstandings or conflicts related to compensation.

Compliance with Regulations

Pay stubs are essential for ensuring compliance with federal, state, and local labor laws. These laws often require employers to provide employees with detailed pay information, including gross wages, deductions, and net pay. By issuing accurate and comprehensive pay stubs, employers can avoid penalties for non-compliance and demonstrate their commitment to following legal requirements.

Documentation for Disputes

In the event of a wage dispute or discrepancy, pay stubs serve as valuable evidence to support or resolve the issue. Employees can refer to their pay stubs to verify the accuracy of their earnings and deductions, while employers can use pay stubs to investigate any potential errors or misunderstandings. By maintaining thorough records of pay stubs, both parties can resolve disputes quickly and fairly.

What Information Goes On A Pay Stub?

A typical pay stub will include the following information:

- Gross wages: The total amount of money earned before deductions

- Taxes withheld: Federal, state, and local taxes withheld from the employee’s paycheck

- Deductions: Any voluntary deductions for benefits such as health insurance, retirement contributions, or union dues

- Net pay: The amount of money the employee takes home after all deductions

Do States Require Employers To Provide Pay Stubs?

While federal law does not mandate the provision of pay stubs, many states have their own regulations regarding pay stubs. Some states require employers to provide detailed pay stubs with specific information, while others allow electronic pay stubs as long as employees have access to them.

Employers need to be aware of the laws in their state and ensure compliance with pay stub requirements.

Best Practices For Pay Stubs

Employers can follow these best practices to ensure accurate and compliant pay stubs:

Include All Required Information

Ensure that pay stubs contain all necessary details, including gross wages, taxes withheld, deductions, and net pay. Providing a comprehensive breakdown of an employee’s compensation helps promote transparency and avoid confusion.

Keep Accurate Records

Maintain thorough records of pay stubs for each employee to ensure accuracy and compliance with state regulations. Accurate record-keeping is essential for resolving any disputes or discrepancies that may arise.

Provide Pay Stubs On Time

Ensure that employees receive their pay stubs along with their paychecks or have access to them electronically on time. Timely delivery of pay stubs demonstrates respect for employees and helps them manage their finances effectively.

Communicate Clearly

Explain any deductions or changes on the pay stub clearly to avoid confusion or disputes. Effective communication regarding pay stub information can help employees understand their compensation and benefits better.

Review for Errors

Double-check pay stubs for accuracy before distributing them to employees to prevent mistakes or discrepancies. Regularly reviewing pay stubs for errors helps maintain compliance with wage laws and ensures that employees are paid correctly.

Ensure Confidentiality

Protect the confidentiality of employee pay stubs by securely storing and distributing them. Pay stubs contain sensitive financial information and must be handled with care to prevent unauthorized access or disclosure.

Offer Online Access

Consider providing employees with online access to their pay stubs for added convenience and accessibility. Online portals or apps can make it easier for employees to view and download their pay information at any time.

Seek Legal Advice

If you are unsure about the pay stub requirements in your state or have questions about compliance, seek legal advice or consult with a payroll specialist. Staying informed about pay stub laws and regulations can help you avoid legal issues and ensure compliance with all requirements.

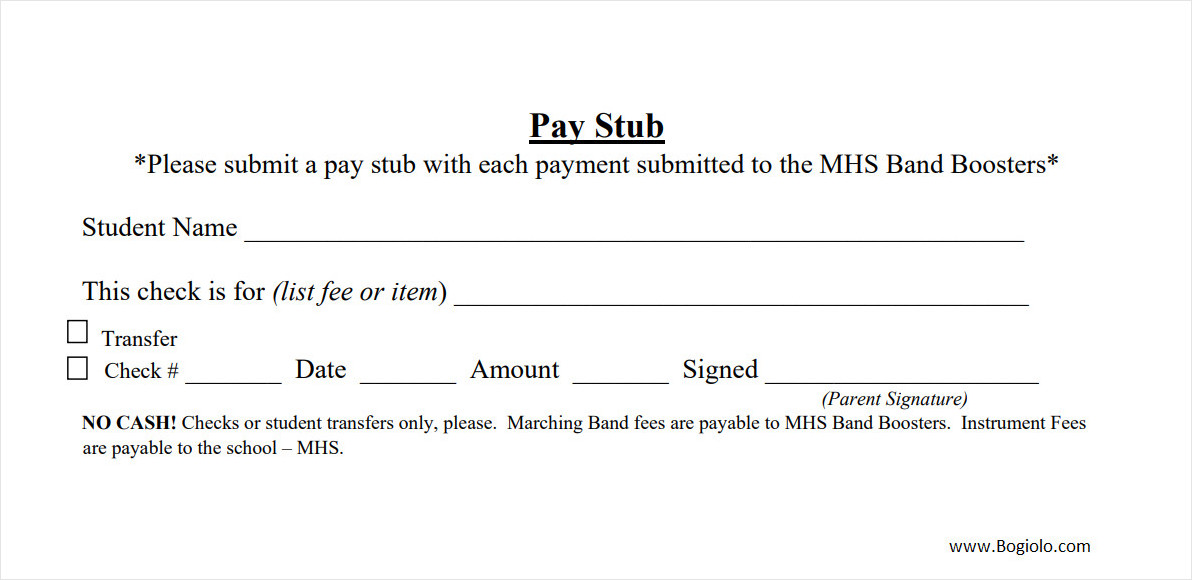

Pay Stub Template

A pay stub is an essential tool for recording employee earnings, deductions, and net pay in a clear and professional format. It helps employers provide transparency while allowing employees to track their income accurately.

To make payroll management simple and organized, use our free pay stub template and create professional pay stubs with ease!

Pay Stub Template – Download