Are you tired of feeling stressed about money? Are you struggling to make ends meet or unsure where your hard-earned cash is disappearing to each month? If so, a monthly budget planner might just be the solution you need to take control of your finances and start working towards your financial goals.

A budget planner is a powerful tool that can help you track your income and expenses, understand your spending habits, pay bills on time, save for the future, reduce debt, and be prepared for any unexpected emergencies that may come your way. By using a budget planner, you can reduce financial stress and gain greater confidence in your ability to manage your money effectively.

What is a Monthly Budget Planner?

A monthly budget planner is a tool that helps you keep track of your income and expenses, allowing you to see exactly where your money is going each month. It typically consists of different sections where you can input your various sources of income, list out all your expenses, and calculate your total savings.

By using a budget planner, you can create a comprehensive overview of your financial situation and make informed decisions about how to allocate your money.

Why Use a Monthly Budget Planner?

There are numerous benefits to using a monthly budget planner to manage your finances. Here are a few reasons why you should consider incorporating a budget planner into your financial routine:

Gain Control

A budget planner helps you gain control over your finances by providing a clear picture of your income and expenses. It allows you to see where your money is going and identify areas where you can make adjustments.

Adjust Spending Habits

By tracking your expenses, you can identify patterns in your spending habits and make changes to align with your financial goals. This awareness empowers you to reduce unnecessary expenses and prioritize what truly matters.

Pay Bills On Time

With a budget planner, you can stay organized and ensure that you have enough funds to cover your bills each month. By setting aside money for essential expenses, you can avoid late payments and unnecessary fees.

Save for the Future

Setting savings goals in your budget planner allows you to allocate a portion of your income towards building a financial cushion for the future. Whether it’s for retirement, a vacation, or an emergency fund, saving money regularly is key to achieving your long-term objectives.

Reduce Debt

By tracking your debts and creating a repayment plan in your budget planner, you can work towards paying off outstanding balances and becoming debt-free. This proactive approach to debt management can help improve your financial well-being.

Prepare for Emergencies

Life is full of unexpected events, and having an emergency fund is essential to weathering financial storms. A budget planner can help you set aside funds for unforeseen expenses, giving you peace of mind and financial security.

Reduce Financial Stress

One of the biggest advantages of using a budget planner is the reduction of financial stress. By having a clear overview of your finances and a plan in place, you can minimize worries about money and feel more confident in your ability to manage your financial future.

Key Elements of a Monthly Budget Planner

A monthly budget planner typically includes the following key elements:

Income Tracking

Tracking your income is essential for understanding how much money you have coming in each month. This includes wages, bonuses, rental income, and any other sources of revenue.

Expense Categories

Organizing your expenses into categories helps you identify where your money is going and where you can potentially cut back. Common expense categories include housing, transportation, groceries, entertainment, and utilities.

Savings Goals

Setting savings goals gives you a clear target to work towards and helps you prioritize saving money for the future. Whether it’s for a specific purchase or a rainy day fund, having savings goals keeps you focused on your financial objectives.

Debt Repayment Plan

If you have outstanding debts, creating a repayment plan in your budget planner is crucial for managing your debt effectively. By allocating funds towards debt repayment, you can reduce interest costs and work towards becoming debt-free.

Emergency Fund

An emergency fund acts as a safety net for unexpected expenses such as medical bills, car repairs, or job loss. Including an emergency fund in your budget planner ensures that you are prepared for any financial curveballs that may come your way.

How to Create and Use a Monthly Budget Planner

Creating and using a monthly budget planner is a straightforward process that can have a significant impact on your financial well-being. Here are some steps to help you get started:

Gather Your Financial Information

Collecting all your financial documents, such as pay stubs, bills, bank statements, and investment accounts, is the first step in creating a comprehensive budget planner. This information will help you accurately track your income and expenses.

Set Financial Goals

Determine what you want to achieve with your budget planner, whether it’s saving for a down payment on a house, paying off student loans, or building an emergency fund. Setting clear financial goals will guide your budgeting decisions and motivate you to stay on track.

List Your Income and Expenses

Start by listing out all your sources of income and categorizing your expenses. Be thorough in documenting your expenses, including fixed costs like rent and utilities, as well as variable expenses like dining out and entertainment.

Calculate Your Savings

Once you have a clear picture of your income and expenses, determine how much you want to save each month. Setting aside a portion of your income for savings is essential for achieving your financial goals and building financial security.

Track Your Progress

Regularly update your budget planner with your actual income and expenses to monitor your progress towards your financial goals. Tracking your spending habits will help you identify areas where you can make adjustments to stay on track.

Review and Adjust

Periodically review your budget planner to see where you can make improvements or cut back on expenses. Adjusting your budget as needed ensures that you are aligning your spending with your financial objectives and making the most of your money.

Stay Consistent

Consistency is key to successful budgeting. Make it a habit to update your budget planner regularly and stick to your financial plan. By staying consistent with your budgeting efforts, you will be able to achieve long-term financial success.

Tips for Successful Budgeting

Here are some additional tips to help you make the most of your monthly budget planner:

Be Realistic

When setting financial goals and creating a budget, it’s important to be realistic about your income and expenses. Setting unattainable goals can lead to frustration and derail your budgeting efforts.

Track Every Expense

Don’t overlook small expenses, as they can add up over time. Be diligent in tracking every expense, no matter how insignificant it may seem. This level of detail will give you a comprehensive view of your spending habits.

Use Technology

Consider using budgeting apps or online tools to simplify the budgeting process and keep everything organized. These tools can automate tracking expenses, setting reminders for bill payments, and generating reports to analyze your financial data.

Celebrate Milestones

Acknowledge your progress and celebrate when you reach financial milestones or goals. Whether it’s paying off a credit card or reaching a savings target, celebrating your achievements can motivate you to continue working towards your financial objectives.

Seek Support

Don’t be afraid to seek help or guidance from financial advisors or support groups if you need assistance with budgeting. Getting advice from professionals or connecting with others who are on a similar financial journey can provide valuable insights and encouragement.

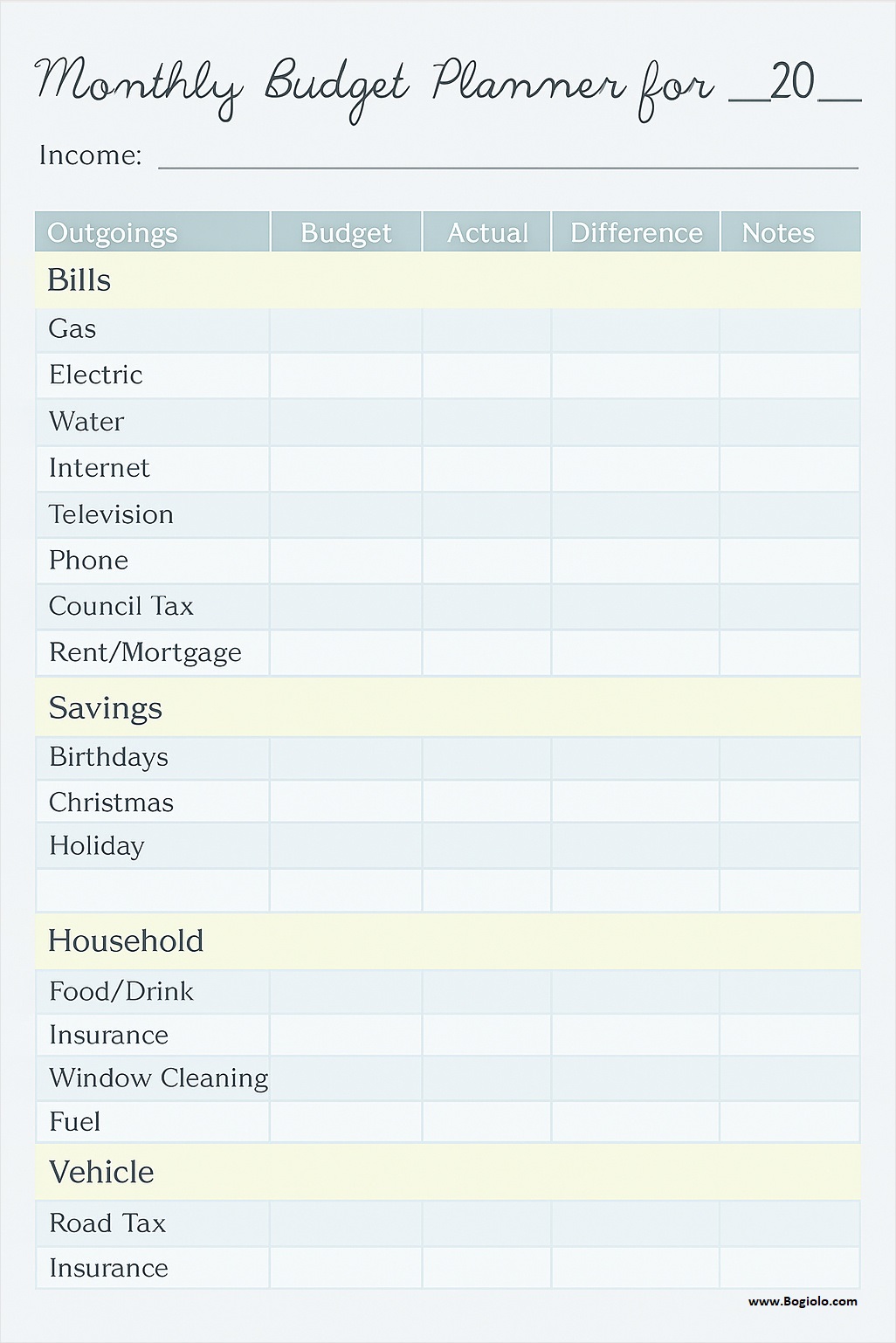

Monthly Budget Planner Template

A monthly budget planner is a simple yet effective tool for managing your income and expenses throughout the month. It helps you track spending, set savings goals, and stay within budget, giving you a clear overview of your financial health. Perfect for individuals, families, or small businesses, this template makes money management easier and more organized.

Download and use our monthly budget planner template today to take control of your finances, reduce stress, and achieve your financial goals.

Monthly Budget Planner Template – DOWNLOAD