Money management is a crucial aspect of our daily lives, yet many of us struggle to effectively control our finances. With the constant influx of income and the numerous expenses that come our way, it can be challenging to keep track of where our money is going. This is where a money management worksheet comes into play.

By utilizing this tool, you can gain a clearer understanding of your financial situation, create a budget that works for you, identify your spending habits, and set achievable financial goals.

Ultimately, a money management worksheet serves as a roadmap for your financial journey, guiding you towards making informed and purposeful decisions about your money.

What is a Money Management Worksheet?

A money management worksheet is a tool that helps individuals track their income and expenses, create a budget, identify spending habits, and set financial goals. It provides a comprehensive overview of your finances, allowing you to see where your money is coming from and where it is going.

By utilizing a money management worksheet, you can gain better control over your finances and work towards achieving your financial objectives.

Why Should You Use a Money Management Worksheet?

There are several reasons why using a money management worksheet is beneficial for your financial health:

Clarity

A money management worksheet provides a detailed breakdown of your income sources and expenses, giving you a comprehensive view of your financial situation. This clarity allows you to make informed decisions about how to manage your money effectively and work towards your financial goals.

Budgeting

Creating a budget using a money management worksheet helps you allocate your income towards essential expenses, savings goals, and discretionary spending. It enables you to prioritize your financial needs and make conscious choices about where your money goes.

Identifying Spending Habits

Tracking your expenses through a money management worksheet allows you to identify patterns in your spending habits. You can see where your money is being spent, recognize areas where you may be overspending, and make adjustments to align your spending with your financial goals.

Setting Financial Goals

A money management worksheet provides a platform for setting specific financial goals, whether it’s building an emergency fund, paying off debt, saving for a vacation, or investing for retirement. By establishing clear objectives, you can track your progress and stay motivated to achieve financial success.

Control Spending

By using a money management worksheet to track your expenses and income, you can gain better control over your spending habits. This awareness allows you to make conscious choices about where to allocate your money, avoid unnecessary purchases, and focus on your long-term financial priorities.

Key Elements of a Money Management Worksheet

A comprehensive money management worksheet typically includes the following key elements:

- Income Tracking: Documenting all sources of income, including salaries, bonuses, and any other forms of earnings.

- Expense Tracking: Recording all expenses, such as bills, groceries, entertainment, and other discretionary spending.

- Budgeting Section: Allocating funds for various categories, such as housing, transportation, food, and savings.

- Debt Tracking: Monitoring outstanding debts, such as credit card balances, loans, and other liabilities.

- Financial Goals: Setting short-term and long-term financial goals, such as saving for emergencies, retirement, or a vacation.

How to Use a Money Management Worksheet

Utilizing a money management worksheet effectively involves the following steps:

Gather Your Financial Information

Start by collecting all relevant financial documents, such as pay stubs, bank statements, bills, and credit card statements. Having all your financial information in one place will make it easier to create an accurate money management worksheet.

Track Your Income

Record all sources of income, including wages, bonuses, side hustles, rental income, and any other money coming in. Make sure to include both regular income and any irregular or one-time payments to get a complete picture of your financial resources.

Track Your Expenses

Document all your expenses, both fixed and variable, to see where your money is going. Categorize your expenses into different categories, such as housing, transportation, groceries, entertainment, and savings, to understand your spending patterns and identify areas for improvement.

Create a Budget

Use the information gathered from tracking your income and expenses to create a budget that reflects your financial goals and priorities. Allocate your income towards different categories based on your needs and set limits for each category to ensure you’re living within your means.

Identify Spending Habits

Review your expense tracking data to identify any patterns or trends in your spending habits. Are you overspending in certain areas? Are there expenses you can cut back on or eliminate? Use this information to adjust your budget and make more informed decisions about your spending.

Set Financial Goals

Determine what you want to achieve with your money in the short term and long term. Whether it’s building an emergency fund, paying off debt, saving for a vacation, or investing for retirement, setting clear financial goals will give you direction and motivation to stick to your budget and make progress towards financial stability.

Review and Adjust Regularly

Regularly review your money management worksheet to track your progress towards your financial goals and make any necessary adjustments. Life circumstances change, and your financial situation may evolve, so it’s important to revisit your budget, expenses, and goals regularly to stay on track and make informed decisions about your money.

Tips for Successful Money Management

To make the most of your money management worksheet, consider the following tips:

Be Consistent

Consistency iskey to successful money management. Make it a habit to update your money management worksheet regularly, whether it’s weekly, bi-weekly, or monthly. This will help you stay on top of your finances, track your progress, and make adjustments as needed to reach your financial goals.

Track Every Expense

Don’t overlook any expenses, no matter how small they may seem. Every coffee, snack, or impulse purchase adds up over time and can impact your overall financial health. By tracking every expense, you can get a complete picture of your spending habits and identify areas where you can cut back.

Review Your Progress

Regularly assess your financial goals and budget to see how you’re progressing. Are you staying within your budget limits? Are you making progress towards your savings goals? Use this information to make adjustments as needed and stay motivated to achieve financial success.

Seek Professional Help

If you’re struggling with managing your finances or need help reaching your financial goals, don’t hesitate to seek guidance from a financial planner or advisor. They can provide personalized advice, help you create a financial plan, and offer strategies to improve your financial situation.

Celebrate Milestones

Don’t forget to celebrate your financial milestones along the way. Whether it’s paying off a credit card, reaching a savings goal, or sticking to your budget for a month, acknowledging your achievements can boost your confidence and motivation to continue making progress towards your financial goals.

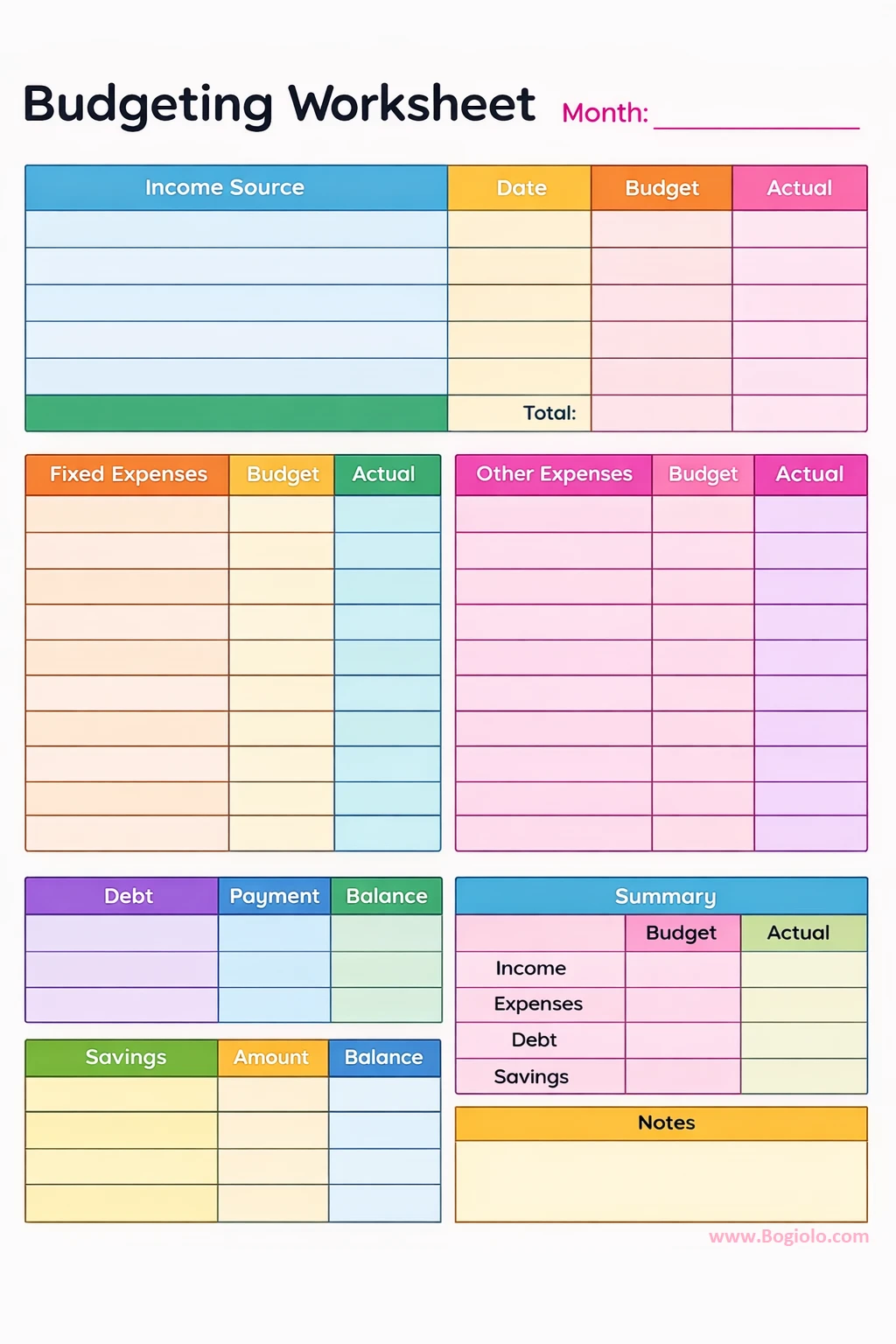

Money Management Worksheet Template

A Money Management Worksheet helps you track income, expenses, savings, and financial goals in a clear and organized format. It provides a structured approach to understanding spending habits and improving financial decision-making. With a well-designed template, you can build better money habits, stay on budget, and work toward long-term financial stability.

Download our Money Management Worksheet Template today to take control of your finances with clarity and confidence.

Money Management Worksheet Template – DOWNLOAD