In today’s fast-paced world, many individuals find themselves constantly on the move. Whether you’re a self-employed individual looking to claim tax deductions or an employee seeking reimbursement for business-related travel, maintaining a mileage log is crucial.

This log serves as an accurate, auditable record of your vehicle use, providing detailed information about each trip’s date, destination, business purpose, and odometer readings. By keeping a mileage log, you can ensure compliance with tax authorities like the IRS, prove the legitimacy of claimed expenses, and avoid penalties.

What is a Mileage Log?

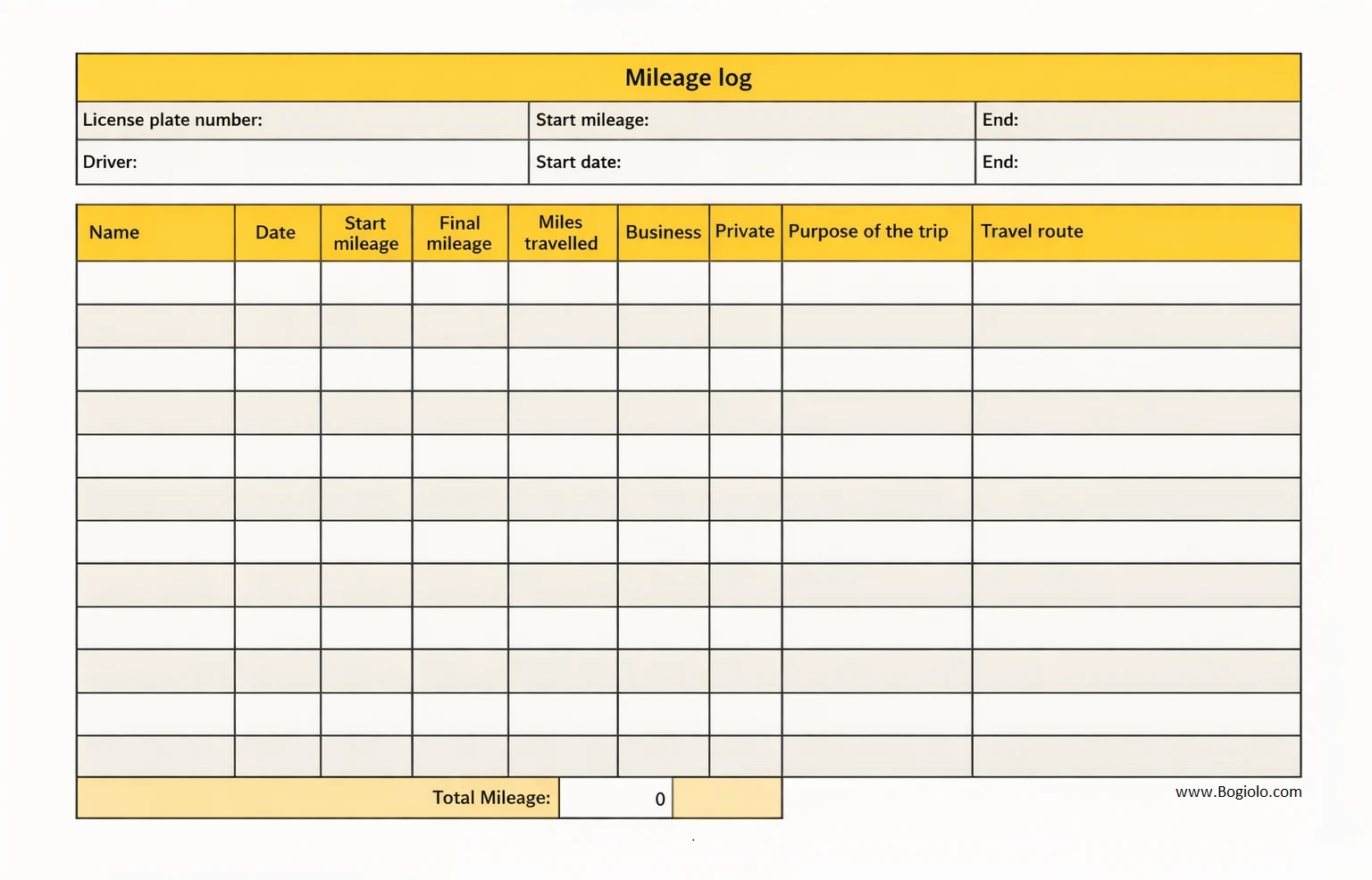

A mileage log is a document that tracks the miles driven for business purposes. It includes essential details such as the date of the trip, the destination, the purpose of the trip, and the starting and ending odometer readings. This log serves as evidence to support any tax deductions or reimbursements claimed for business-related travel.

Maintaining a mileage log may seem like a tedious task, but it is a necessary one for individuals who rely on their vehicles for work purposes. Without a detailed record of your mileage, it can be challenging to prove the validity of your claimed expenses to tax authorities.

Why is a Mileage Log Important?

A mileage log is essential for several reasons. Firstly, it allows self-employed individuals to claim tax deductions for the business use of their vehicles. Without a mileage log, it can be challenging to differentiate between personal and business-related mileage, potentially leading to inaccuracies in tax filings.

Secondly, a mileage log is crucial for employees seeking reimbursement for business-related travel. Employers often require detailed records of mileage to process reimbursements accurately. By maintaining a mileage log, employees can provide clear evidence of their travel for work purposes.

Key Elements of a Mileage Log

A comprehensive mileage log should include the following key elements:

- Date: Record the date of each trip for accurate tracking.

- Destination: Note the destination of the trip, whether it’s a client meeting or a job site.

- Business Purpose: Specify the reason for the trip, such as a sales visit or conference attendance.

- Odometer Readings: Record the starting and ending odometer readings to calculate the total miles driven.

How to Maintain a Mileage Log

Maintaining a mileage log doesn’t have to be complicated. Here are some tips to help you keep an accurate record of your vehicle use:

- Use a dedicated logbook or mobile app: Choose a method that works best for you to track your mileage consistently.

- Record trips immediately: Don’t wait to log your trips, as details may become fuzzy over time.

- Be detailed: Include all relevant information, such as the purpose of the trip and any client meetings attended.

- Review and update regularly: Take time to review your mileage log periodically to ensure accuracy and make any necessary updates.

Tips for Effective Mileage Tracking

To make the most of your mileage log and ensure compliance with tax regulations, consider the following tips:

- Separate personal and business mileage: Keep personal and business-related trips separate to avoid confusion.

- Use GPS tracking: Consider using GPS technology to accurately track your mileage and streamline the logging process.

- Consult a tax professional: If you’re unsure about what expenses to include in your mileage log, seek advice from a tax professional.

- Keep receipts and supporting documents: In addition to your mileage log, retain receipts and other documentation to substantiate your claimed expenses.

Conclusion

In conclusion, maintaining a mileage log is a crucial task for self-employed individuals and employees seeking tax deductions or reimbursements for business-related travel. By keeping a detailed record of your vehicle use, you can ensure compliance with tax authorities, prove the legitimacy of claimed expenses, and avoid penalties.

Remember to include essential details such as the date of the trip, destination, business purpose, and odometer readings in your mileage log. By following the tips outlined in this article, you can effectively track your mileage and maximize your tax benefits.

Mileage Log Template – DOWNLOAD