What is a Money Receipt?

A money receipt is a crucial document that serves as evidence of a financial transaction between a buyer and a seller. It acts as a confirmation that payment has been successfully made by the buyer and received by the seller.

Money receipts can vary in format, including physical paper receipts, digital receipts, or electronic receipts. Regardless of the form, the primary purpose of a money receipt is to document the transaction and provide a record of payment.

Why Are Money Receipts Important?

Money receipts play a crucial role in financial transactions for several reasons. Let’s delve deeper into the significance of money receipts in ensuring transparency, accountability, and trust in financial dealings.

Proof of Payment

One of the primary reasons why money receipts are important is that they serve as concrete proof of payment. For buyers, a money receipt acts as evidence that they have fulfilled their financial obligation by making the necessary payment to the seller. This proof of payment is essential for tracking expenses, budgeting, and ensuring that all financial transactions are accounted for.

For sellers, money receipts confirm that they have received the payment for the goods or services provided. This acknowledgment is crucial for maintaining accurate financial records, tracking revenue, and reconciling accounts. By providing a clear record of the transaction, money receipts help both parties avoid any confusion or disputes regarding the payment.

Record Keeping

Money receipts also play a vital role in record-keeping. By documenting the details of the transaction, including the date, amount, payment method, and description of the goods or services purchased, money receipts provide a comprehensive record of the financial transaction. This record is invaluable for individuals and businesses alike, helping them track their expenses, monitor cash flow, and prepare financial statements.

Moreover, money receipts serve as a reference point for future inquiries or audits. In case there are any questions or discrepancies regarding a particular transaction, having a money receipt can provide clarity and evidence to support the details of the payment. This documentation helps ensure transparency and accuracy in financial records, enabling parties to verify the authenticity of the transaction.

Dispute Resolution

In addition to serving as proof of payment and aiding in record-keeping, money receipts are essential for dispute resolution. In the event of any disagreements or disputes between the buyer and the seller, having a money receipt can help clarify the terms and conditions of the transaction. The receipt contains critical information, such as the date, amount, payment method, and description of the transaction, which can be used as evidence to resolve any misunderstandings or conflicts.

By providing a written record of the payment made and received, money receipts help parties validate the terms of the agreement and ensure that both sides have fulfilled their obligations. This documentation is particularly useful in cases where there is a discrepancy in the amount paid, the goods or services received, or the payment method used. By referring to the money receipt, parties can address any issues promptly and resolve them effectively.

Key Elements of a Money Receipt

While money receipts can vary in format and design, they typically contain essential elements that are crucial for documenting a financial transaction accurately. Let’s explore the key elements that are commonly included in money receipts and their significance in providing a comprehensive record of the payment.

Date

The date of the transaction is a fundamental element of a money receipt. It signifies the day when the payment was made by the buyer and received by the seller. Including the date on the receipt helps both parties track the timeline of the transaction and serves as a reference point for future inquiries or disputes. By noting the date of the payment, money receipts provide a chronological record of financial activities, enabling parties to monitor their cash flow and financial transactions effectively.

Moreover, the date on the receipt helps parties reconcile accounts, prepare financial statements, and ensure that all transactions are accurately recorded. By documenting the date of the payment, money receipts create a clear timeline of the transaction, making it easier for parties to verify the details of the payment and confirm that the transaction took place on a specific date.

Amount

The total amount of the transaction is a critical element of a money receipt. It represents the sum of money paid by the buyer to the seller for the goods or services purchased. Including the amount on the receipt ensures that both parties have a clear record of the financial transaction and can verify the accuracy of the payment made. The amount serves as a reference point for parties to reconcile accounts, track expenses, and monitor their financial activities.

Moreover, detailing the amount on the receipt helps parties confirm the cost of the goods or services purchased and ensure that they have been charged correctly. By including the total amount of the transaction, money receipts provide transparency and clarity regarding the financial aspect of the transaction, enabling parties to verify the accuracy of the payment and validate the terms of the agreement.

Payment Method

The payment method used for the transaction is another essential element of a money receipt. It specifies how the payment was made, whether in cash, credit card, debit card, check, or other electronic payment methods. Including the payment method on the receipt helps parties track the mode of payment used for the transaction and provides a detailed record of the financial activity.

Moreover, specifying the payment method on the receipt helps parties verify the authenticity of the payment and confirm that the funds were transferred using the agreed-upon method. By including the payment method on the receipt, money receipts provide a comprehensive record of the transaction, enabling parties to track the flow of funds, reconcile accounts, and verify the accuracy of the payment made.

Details of the Transaction

A detailed description of the goods or services purchased is a crucial element of a money receipt. It provides information about the products or services exchanged in the transaction, including quantity, quality, specifications, and any other relevant details. Describing the transaction details on the receipt helps parties verify the nature of the transaction and confirm that the goods or services purchased match the description provided.

Additionally, including the details of the transaction on the receipt helps parties track their purchases, monitor inventory, and ensure that the products or services received meet their expectations. By documenting the transaction details on the receipt, money receipts create a comprehensive record of the goods or services exchanged, enabling parties to verify the accuracy of the transaction and confirm that all terms have been met.

Seller’s Information

The seller’s information is an essential element of a money receipt. It includes details such as the seller’s name, address, contact information, and any other relevant identifying information. Providing the seller’s information on the receipt helps parties identify the seller and establish a contact point for future inquiries or communication regarding the transaction.

Moreover, including the seller’s information on the receipt helps

Buyer’s Information

Similarly, the buyer’s information is a crucial element of a money receipt. It consists of details such as the buyer’s name, address, contact information, and any other relevant identifying information. Including the buyer’s information on the receipt helps parties identify the buyer and establish a communication channel for future interactions or follow-ups related to the transaction.

How to Create a Money Receipt

Creating a money receipt is a straightforward process that involves capturing all the essential details of the financial transaction accurately. Let’s explore the steps to create a money receipt effectively and ensure that all necessary information is included for a comprehensive record of the payment.

Choose a Format

The first step in creating a money receipt is to decide on the format of the receipt. Depending on the nature of the transaction and the preferences of the parties involved, you can choose between physical paper receipts, digital receipts, or electronic receipts. Consider the convenience, accessibility, and practicality of each format to select the most suitable option for documenting the transaction.

Physical paper receipts are ideal for in-person transactions or retail purchases where a tangible record of the transaction is required. Digital receipts, such as emails or text messages, offer a convenient way to provide a receipt electronically and ensure that the receipt is easily accessible and retrievable. Electronic receipts generated and stored digitally are suitable for online transactions or automated payments, providing a secure and efficient way to document the transaction.

Include Key Information

Once you have chosen the format of the money receipt, the next step is to include all the key information necessary to document the financial transaction accurately. Ensure that the receipt contains essential details such as the date of the transaction, the total amount paid, the payment method used, a detailed description of the goods or services purchased, the seller’s information, and the buyer’s information.

By including all the key information on the receipt, you create a comprehensive record of the transaction that is clear, accurate, and detailed. This information serves as a reference point for both parties to track the payment, verify the details of the transaction, and ensure that all terms and conditions of the agreement have been met.

Provide a Receipt Number

Assigning a unique receipt number to each money receipt is essential for record-keeping and tracking purposes. The receipt number helps parties identify and differentiate individual transactions, making it easier to reference specific payments and reconcile accounts. By providing a receipt number on the receipt, you create a systematic way to organize and manage financial records efficiently.

Moreover, the receipt number serves as a tracking mechanism for both parties to monitor the status of the transaction and refer back to the receipt for future inquiries or follow-ups. By assigning a unique receipt number to each money receipt, you establish a structured system for recording and storing financial transactions, ensuring that all payments are accounted for and documented accurately.

Sign and Date

Finally, both parties should sign and date the money receipt to acknowledge the completion of the transaction and confirm their agreement to the terms and conditions outlined in the receipt. Signing and dating the receipt adds a layer of authenticity and validation to the document, indicating that both parties have agreed to the details of the transaction and accepted the terms of the agreement.

By signing and dating the money receipt, parties demonstrate their commitment to the transaction and their willingness to adhere to the terms specified in the receipt. This acknowledgment serves as a form of verification and confirmation that the transaction has been completed successfully, providing both parties with a sense of security and accountability in the financial dealings.

Tips for Successful Money Receipt Transactions

Ensuring successful money receipt transactions involves attention to detail, clear communication, and proper record-keeping practices. Here are some tips to help you navigate money receipt transactions effectively and maintain transparency and accountability in your financial dealings.

Keep Copies

Make sure to keep copies of the money receipt for both parties involved in the transaction. Having duplicate copies of the receipt ensures that each party has a record of the payment made and received, enabling them to refer back to the receipt as needed. Retaining copies of the receipt also serves as a backup in case the original receipt is misplaced or lost.

By keeping copies of the money receipt, parties can safeguard their records and maintain accurate documentation of the transaction. This practice ensures that both parties have access to the receipt for future reference, inquiries, or disputes, providing a reliable record of the financial transaction.

Be Clear and Detailed

When creating a money receipt, be sure to include all relevant information and details of the transaction to avoid any confusion or misunderstandings. Provide a clear and detailed description of the goods or services purchased, specify the payment amount, note the payment method used, and include the date of the transaction. By being clear and detailed in the receipt, you create a comprehensive record that leaves no room for ambiguity.

Moreover, ensure that the receipt is legible, organized, and easy to understand for both parties. Use concise language, avoid jargon or technical terms, and present the information in a structured format that is accessible and straightforward. Being clear and detailed in the money receipt enhances transparency, facilitates communication, and helps parties verify the accuracy of the transaction.

Secure Storage

After creating a money receipt, store the receipt in a secure and accessible location for future reference and retrieval. Keep the receipt in a designated folder, file, or digital storage system that is easily accessible and organized. Storing the receipt securely ensures that it is protected from damage, loss, or unauthorized access.

Regularly review and update your storage system to maintain accurate records of your financial transactions and ensure that all receipts are accounted for. By storing money receipts securely, you create a reliable archive of your financial activities that can be accessed and referenced whenever needed. This practice helps parties track their expenses, monitor payments, and maintain a clear record of their financial transactions.

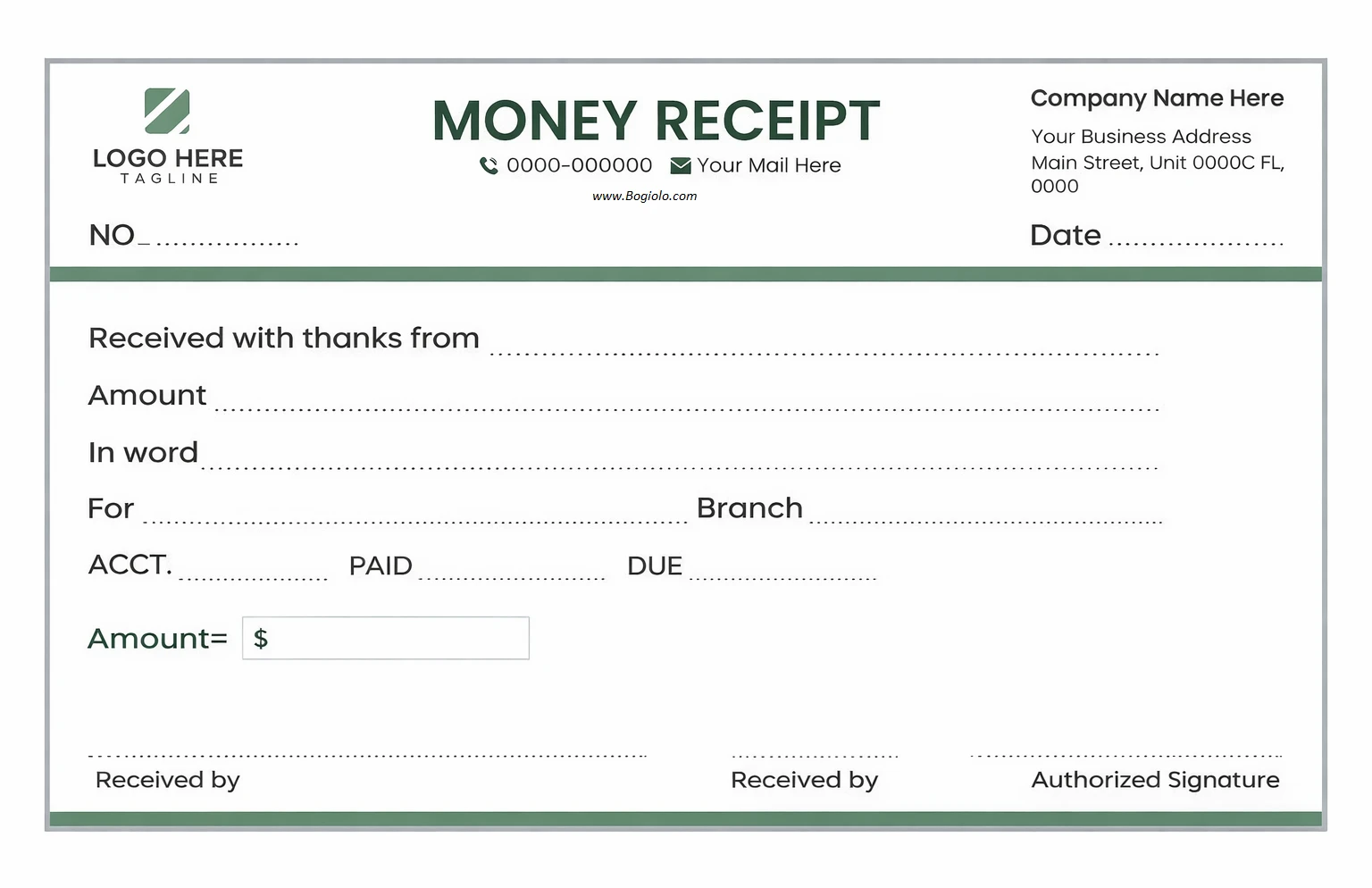

Free Money Receipt Template

A Money Receipt helps you document payments clearly and professionally for personal or business transactions. It provides a structured format for recording payment amounts, dates, methods, and payer details, ensuring transparency and accurate record-keeping. With a well-designed template, you can simplify bookkeeping and provide reliable proof of payment.

Download our Money Receipt Template today to issue clear and professional receipts with confidence.

Money Receipt Template – DOWNLOAD