Tracking your monthly expenses is a crucial aspect of personal finance that can help you understand your financial situation, identify where your money is going, and manage your finances more effectively to achieve financial goals like saving or paying off debt.

By keeping a close eye on your income and spending, you can compare your budgeted amounts with actual spending to make informed decisions, spot areas where you can cut costs, and stay accountable for your financial decisions.

What Are Monthly Expenses?

Monthly expenses are the recurring costs that you incur regularly, such as rent or mortgage payments, utilities, groceries, transportation, insurance premiums, and entertainment.

By tracking these expenses, you can gain a clear picture of your financial habits and identify areas where you may be overspending.

Why Track Monthly Expenses?

Tracking your monthly expenses is essential for several reasons:

Understanding Your Financial Habits

By closely monitoring your expenses, you can gain a deeper understanding of your spending patterns and habits. This awareness can help you identify areas where you may be overspending or making unnecessary purchases, allowing you to make adjustments to your budget and prioritize your financial goals.

Budgeting Effectively

Tracking your monthly expenses is essential for creating and sticking to a budget. By knowing exactly how much you are spending in each category, you can allocate your income more effectively, avoid overspending, and ensure that you have enough funds for savings or debt repayment.

Identifying Areas to Cut Costs

One of the primary benefits of tracking your monthly expenses is the ability to pinpoint areas where you can cut costs. By analyzing your spending habits, you can identify non-essential expenses that can be reduced or eliminated, freeing up more money to put towards your financial goals.

Setting Financial Goals

Tracking your expenses is essential for setting and achieving financial goals. Whether you are saving for a major purchase, building an emergency fund, or paying off debt, understanding your monthly expenses can help you create a realistic plan to reach your objectives.

Staying Accountable

Regularly tracking your expenses holds you accountable for your financial decisions. By reviewing your spending habits and comparing them to your budget, you can make adjustments as needed to stay on track with your financial goals and avoid unnecessary debt or overspending.

Key Elements of Tracking Monthly Expenses

When tracking your monthly expenses, there are several key elements to consider:

Income Tracking

Tracking your income is the first step in understanding your financial situation. This includes all sources of income, such as wages, bonuses, freelance work, or rental income. By knowing how much money you have coming in each month, you can better plan and budget for your expenses.

Fixed Expenses

Fixed expenses are recurring costs that remain constant each month, such as rent or mortgage payments, insurance premiums, and subscription services. These expenses are typically non-negotiable and must be factored into your budget to ensure they are paid on time.

Variable Expenses

Variable expenses are costs that fluctuate from month to month, such as groceries, dining out, entertainment, and transportation. These expenses can be adjusted based on your needs and financial goals, making them important to track to avoid overspending.

Saving and Investing

Allocating a portion of your income towards savings and investments is crucial for building wealth and achieving long-term financial security. By tracking your savings and investment contributions each month, you can ensure that you are making progress towards your financial goals.

Debt Payments

Debt payments, such as credit card balances, student loans, or car loans, should also be included in your expense tracking. By monitoring your debt payments, you can track your progress towards paying off debt and avoid accumulating additional interest or fees.

How to Track Monthly Expenses

There are several methods you can use to track your monthly expenses:

Manual Tracking

One of the simplest ways to track your expenses is through manual tracking. This involves keeping a detailed log of all your expenses in a notebook or spreadsheet. Each time you make a purchase, record the amount, date, and category to create an accurate picture of your spending habits.

Expense Tracking Apps

Expense tracking apps and software are convenient tools that can automate the expense tracking process. These apps sync with your bank accounts and credit cards to categorize your expenses automatically, providing you with real-time insights into your spending habits and financial trends.

Envelope System

The envelope system is a budgeting method where you allocate cash into envelopes for different spending categories, such as groceries, dining out, or entertainment. Once an envelope is empty, you cannot spend any more money in that category for the month, helping you stay within budget and avoid overspending.

Credit Card Statements

Reviewing your credit card statements regularly can also help you track your monthly expenses. By examining your credit card transactions, you can categorize your spending, identify areas where you may be overspending, and make adjustments to your budget accordingly.

Tips for Effective Expense Tracking

Here are some tips to help you track your monthly expenses more effectively:

Create a Budget

Establishing a budget is the foundation of effective expense tracking. Outline your income, fixed expenses, variable expenses, savings goals, and debt payments to create a clear roadmap for your financial decisions. Be sure to revisit and adjust your budget regularly to reflect changes in your financial situation.

Review Regularly

Set aside time each week or month to review your expenses and make adjustments to stay on track. By regularly reviewing your spending habits, you can identify any deviations from your budget and take corrective action to ensure you are meeting your financial goals.

Categorize Expenses

Grouping similar expenses can help you better understand your spending patterns and identify areas for improvement. Common expense categories include housing, transportation, food, utilities, entertainment, and personal care. Categorizing your expenses can provide valuable insights into where your money is going and where you may need to cut costs.

Set Realistic Goals

Define clear financial goals, such as saving for a vacation, purchasing a home, or paying off debt. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can track your progress and stay motivated to make positive financial decisions.

Seek Professional Help

If you are struggling to manage your finances or need assistance with creating a budget, consider seeking advice from a financial advisor, accountant, or credit counselor. These professionals can provide personalized guidance and strategies to help you achieve your financial goals and improve your overall financial health.

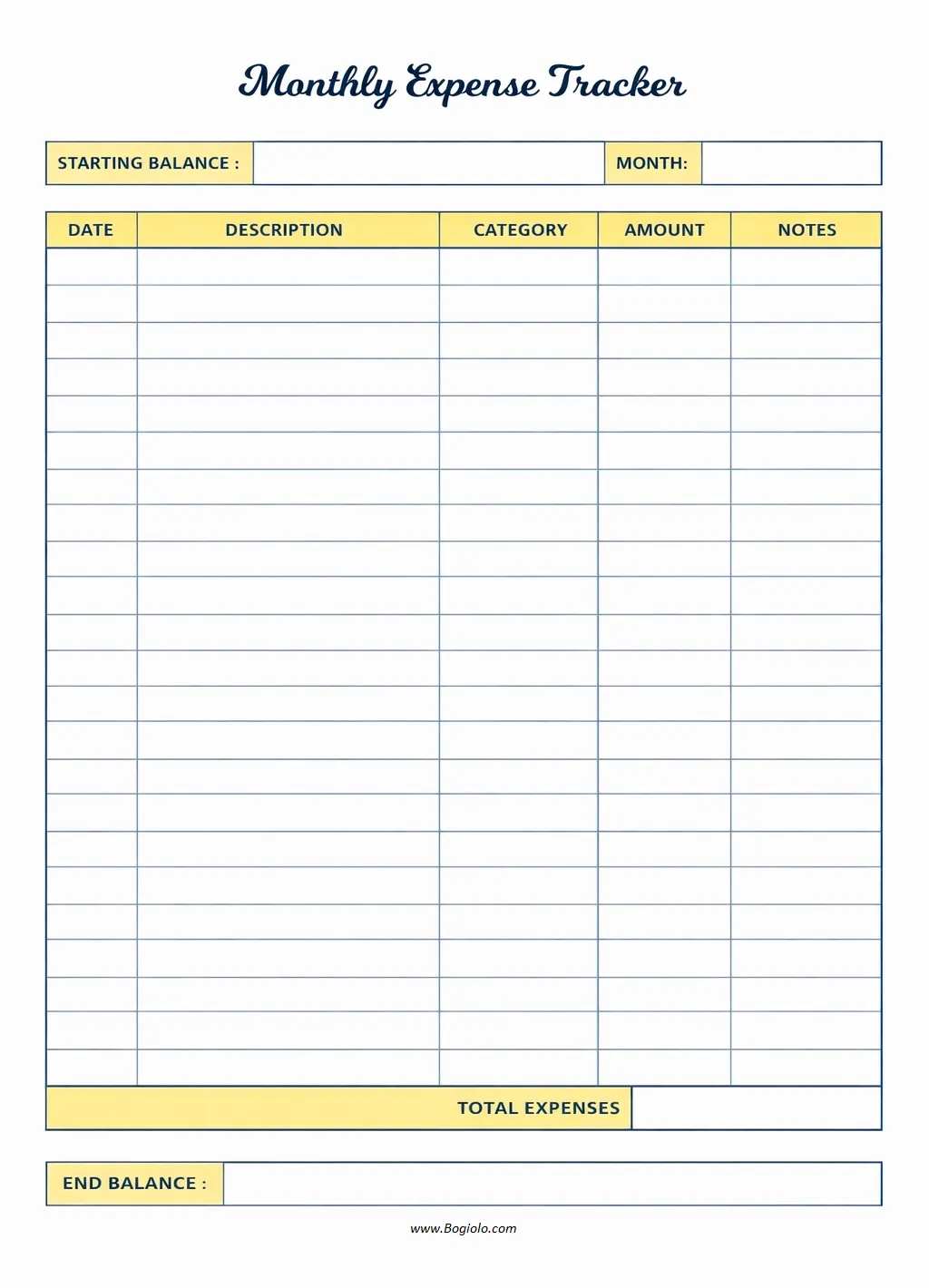

Monthly Expenses Template

A Monthly Expenses helps you track and manage your spending in a clear and organized way. It allows you to record income, categorize expenses, and monitor financial habits, making it easier to stay within budget and plan. With a well-structured template, you can gain better control over your finances and make more informed money decisions.

Download our Monthly Expenses Template today to stay organized and take charge of your monthly budget with confidence.

Monthly Expenses Template – DOWNLOAD