A net worth statement, often referred to as a balance sheet, is a powerful financial tool that provides individuals and entities with a comprehensive snapshot of their financial health at a specific point in time. It essentially serves as a report card for one’s economic standing, showcasing the relationship between assets (what is owned) and liabilities (what is owed).

By calculating the net worth, which is the difference between total assets and total liabilities, individuals can gain valuable insights into their wealth after accounting for all debts.

What Is a Net Worth Statement?

A net worth statement is a detailed document that comprises all the assets and liabilities held by an individual or entity. Assets can include cash, investments, real estate, personal property, and other valuables, while liabilities encompass debts such as loans, mortgages, credit card balances, and outstanding bills.

By collating this information, individuals can create a comprehensive overview of their financial position and assess their net worth.

The Importance Of Your Net Worth Statement

Your net worth statement serves as a crucial tool in assessing your financial well-being and planning for the future.

1. Financial Awareness and Planning

One of the key benefits of maintaining a net worth statement is the increased financial awareness it provides. By regularly evaluating your assets and liabilities, you can gain a better understanding of your financial situation and identify areas where you can make improvements. This heightened awareness can help you make more informed financial decisions, set realistic goals, and create a strategic plan for achieving financial stability.

2. Goal Setting and Monitoring

Your net worth statement can also be a powerful tool for setting and monitoring financial goals. By tracking changes in your net worth over time, you can measure your progress towards achieving specific financial objectives. Whether your goals involve reducing debt, increasing savings, or investing in assets, your net worth statement can help you stay focused and motivated on your path to financial success.

3. Decision Making and Strategy

Understanding your net worth is essential for making sound financial decisions and developing a comprehensive financial strategy. By analyzing your net worth statement, you can assess your current financial position, evaluate potential risks and opportunities, and make informed choices about investments, purchases, and debt management. Your net worth statement serves as a valuable resource for guiding your financial decisions and ensuring that you are on track to achieve your financial goals.

4. Wealth Building and Financial Security

Monitoring your net worth can also be instrumental in building wealth and securing your financial future. By consistently increasing your assets and decreasing your liabilities, you can enhance your net worth over time and build a solid foundation for long-term financial security. Your net worth statement can serve as a roadmap for wealth building, helping you track your progress, make adjustments to your financial plan, and ultimately achieve financial independence and stability.

How to Calculate Net Worth

1. Gathering Financial Information

The first step in calculating your net worth is to gather all relevant financial information, including statements for bank accounts, investment accounts, retirement accounts, real estate holdings, vehicles, personal property, loans, mortgages, credit card balances, and other debts. Having a complete overview of your assets and liabilities is crucial for accurately assessing your net worth.

2. Listing Your Assets

Once you have gathered all your financial information, the next step is to list your assets. This includes cash on hand, savings accounts, investment accounts, retirement savings, real estate properties, vehicles, valuable personal belongings, and any other assets you may own. Assign a current market value to each asset to reflect its worth accurately.

3. Calculating Total Assets

After listing all your assets and assigning values to each, calculate the total value of your assets by adding them together. This sum represents the total worth of all your assets combined and serves as the basis for determining your net worth.

4. Listing Your Liabilities

In addition to listing your assets, you must also document all your liabilities. This includes outstanding debts such as loans, mortgages, credit card balances, student loans, personal loans, and any other financial obligations you may have. Make sure to include the total amount owed for each liability to get an accurate picture of your financial liabilities.

5. Calculating Total Liabilities

Once you have listed all your liabilities and their respective amounts, calculate the total value of your liabilities by adding them together. This total represents the sum of all your outstanding debts and financial obligations, which will be subtracted from your total assets to determine your net worth.

6. Calculating Your Net Worth

To calculate your net worth, subtract the total value of your liabilities from the total value of your assets. The resulting figure is your net worth, representing the difference between what you own (assets) and what you owe (liabilities). Your net worth provides a clear indication of your financial standing and serves as a benchmark for measuring your financial progress over time.

Net Worth in Business

In the business world, net worth plays a critical role in assessing the financial health and value of a company. By calculating net worth, businesses can determine their total worth after accounting for all assets and liabilities. This figure is instrumental in attracting investors, securing financing, evaluating growth opportunities, and assessing overall financial performance.

1. Net Worth Calculation in Business

To calculate the net worth of a business, companies must follow a similar process to that of individuals. By subtracting total liabilities from total assets, businesses can determine their net worth, which represents the value of the company’s equity. Net worth is a key indicator of financial stability and can influence strategic decisions, such as investment choices, expansion plans, and debt management strategies.

2. Financial Analysis and Strategy

Understanding net worth is essential for businesses to conduct thorough financial analysis and develop effective financial strategies. By assessing changes in net worth over time, companies can identify trends, evaluate performance, and make data-driven decisions to support growth and profitability. Net worth serves as a critical metric for measuring financial health and guiding strategic planning in business operations.

3. Investor Confidence and Stakeholder Relations

Net worth is a vital metric that influences investor confidence and stakeholder relations in business. A strong net worth signifies financial stability, growth potential, and sound management practices, which can attract investors and lenders seeking to partner with financially secure companies. By maintaining a healthy net worth and demonstrating consistent growth, businesses can enhance their credibility and build trust with stakeholders.

4. Strategic Planning and Risk Management

Net worth is a foundational element in strategic planning and risk management for businesses. By monitoring changes in net worth and analyzing the factors that contribute to fluctuations, companies can develop proactive strategies to mitigate risks, capitalize on opportunities, and optimize financial performance. Net worth serves as a valuable tool for assessing risk exposure, setting financial goals, and ensuring long-term sustainability in business operations.

Net Worth in Personal Finance

In personal finance, understanding net worth is crucial for individuals to assess their financial health, set goals, and make informed financial decisions. By calculating net worth and tracking changes over time, individuals can gain valuable insights into their wealth position, identify areas for improvement, and plan for their financial future effectively.

1. Personal Net Worth Calculation

Calculating personal net worth involves assessing all assets and liabilities held by an individual. By subtracting total liabilities from total assets, individuals can determine their net worth, which represents their overall financial standing. Personal net worth serves as a benchmark for tracking financial progress, setting goals, and making informed decisions about investments, savings, and debt management.

2. Financial Goal Setting and Monitoring

Tracking changes in net worth enables individuals to set and monitor financial goals effectively. By establishing clear objectives for increasing assets, decreasing liabilities, and growing net worth over time, individuals can stay motivated and focused on achieving financial success. Monitoring net worth regularly allows

3. Individual Financial Planning

Understanding net worth is an essential component of individual financial planning. By analyzing assets, liabilities, and net worth, individuals can create personalized financial plans tailored to their specific goals and circumstances. Net worth serves as a guiding metric for determining the effectiveness of financial strategies, identifying areas for improvement, and ensuring long-term financial stability and security.

4. Wealth Building Strategies

Net worth plays a crucial role in wealth-building strategies for individuals. By increasing assets, reducing liabilities, and growing net worth over time, individuals can enhance their financial well-being and achieve greater financial security. Wealth-building strategies may include saving and investing, debt reduction, budgeting, and diversifying assets to maximize growth opportunities and build long-term wealth.

5. Financial Security and Peace of Mind

Monitoring net worth can provide individuals with a sense of financial security and peace of mind. By tracking changes in net worth, individuals can gain confidence in their financial decisions, plan for unexpected expenses, and secure their future against financial uncertainties. Understanding net worth and taking proactive steps to improve financial health can lead to a greater sense of financial security and stability.

How to Create Your Own Personal Net Worth Statement

Creating a personal net worth statement is a straightforward process that involves gathering financial information, listing assets and liabilities, and calculating net worth. By following a structured approach and updating the statement regularly, individuals can gain valuable insights into their financial position, set goals, and make informed decisions about their finances.

1. Gathering Financial Documents

To create a personal net worth statement, start by gathering all relevant financial documents, including bank statements, investment account statements, property deeds, loan statements, credit card bills, and any other financial records. Having all necessary documents on hand will ensure that your net worth statement is accurate and comprehensive.

2. List Your Assets

List all your assets in your net worth statement, including cash, savings accounts, investment accounts, retirement savings, real estate properties, vehicles, valuable personal belongings, and any other assets you may own. Assign a current market value to each asset to reflect its worth accurately and update these values regularly to track changes in asset values.

3. List Your Liabilities

List all your liabilities in your net worth statement, including debts such as loans, mortgages, credit card balances, student loans, personal loans, and any other financial obligations you may have. Include the total amount owed for each liability to provide a complete picture of your financial liabilities and ensure that your net worth calculation is accurate.

4. Calculate Your Net Worth

Calculate your net worth by subtracting the total value of your liabilities from the total value of your assets. The resulting figure is your net worth, representing the difference between what you own (assets) and what you owe (liabilities). This net worth figure serves as a key indicator of your financial position and can help you make informed decisions about your finances.

5. Review and Update Regularly

Review and update your net worth statement regularly to ensure that it accurately reflects your current financial position. As your financial situation changes, such as changes in asset values or paying off debts, make sure to update your net worth statement accordingly. Regularly reviewing and updating your net worth statement will help you track your financial progress and stay on top of your financial goals.

6. Set Financial Goals

Use your net worth statement to set financial goals and track your progress towards achieving them. Whether your goals involve increasing assets, reducing liabilities, saving for a specific milestone, or investing in long-term growth, your net worth statement can provide a roadmap for achieving financial success. By setting clear and achievable financial goals, you can stay motivated and focused on improving your financial health.

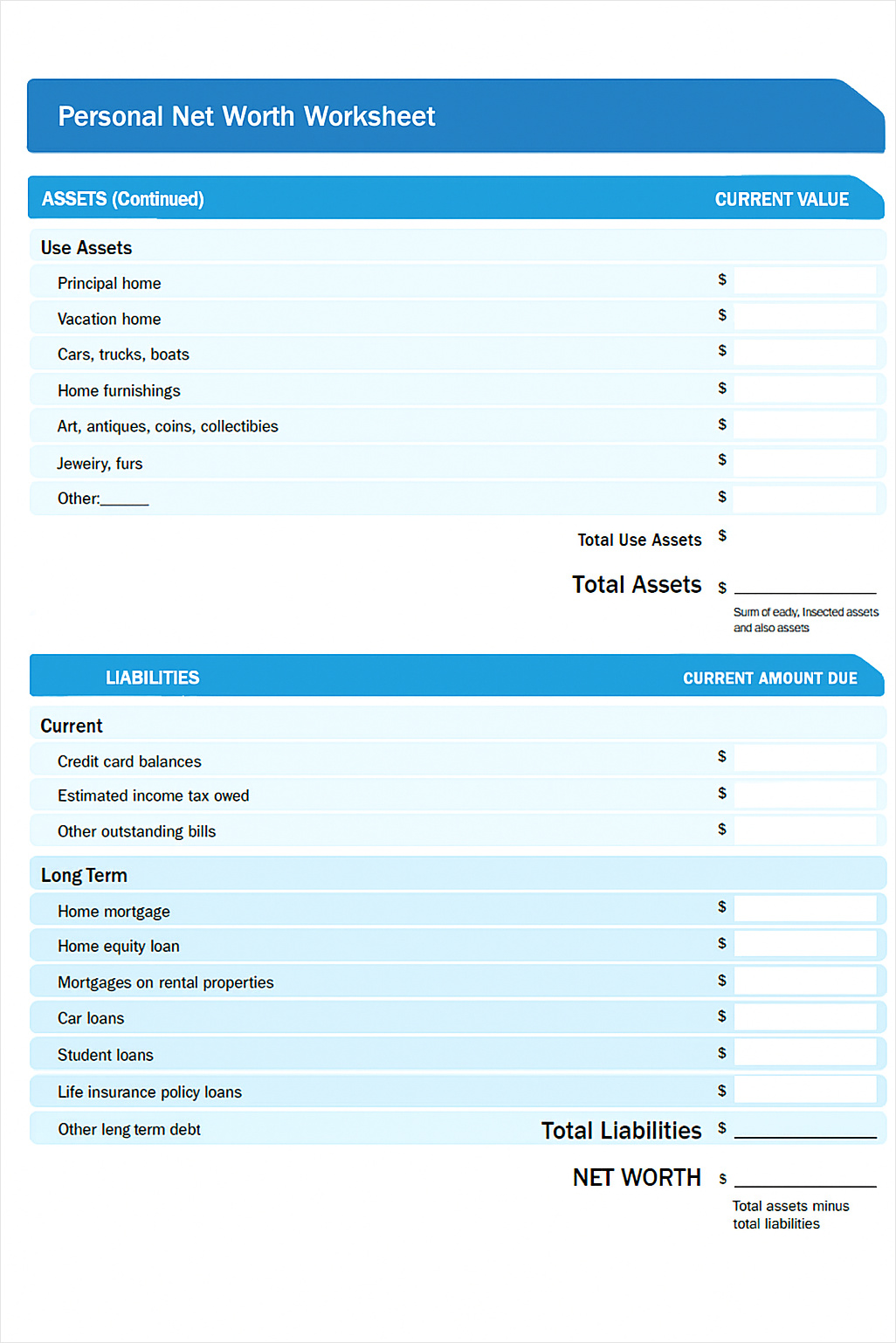

Net Worth Statement Template

A net worth statement is a valuable financial tool for understanding your overall financial health by comparing what you own to what you owe. Whether you’re planning for the future, applying for a loan, or simply tracking progress, a clear and organized template makes the process easier.

Download our free net worth statement template today to get a clear picture of your financial standing. Simple to use, perfect for individuals, families, and small business owners.

Net Worth Statement Template – Download