What Is A Pay-for-Delete Letter?

A pay-for-delete letter is a strategic communication tool used to negotiate with creditors or collection agencies to remove negative marks from your credit report in exchange for payment of the outstanding debt. It is a credit repair tactic that aims to remove blemishes, such as collection accounts, that could otherwise remain on your report for years.

By reaching an agreement with the creditor to delete the negative item upon payment, you can potentially improve your credit score and enhance your overall creditworthiness. Pay-for-delete letters require careful planning, effective communication, and a willingness to negotiate with the other party.

How It Can Affect Your Credit Score

Removing negative marks from your credit report through a pay-for-delete letter has the potential to have a significant impact on your credit score. Negative items such as collection accounts, charge-offs, or late payments can lower your credit score and make it challenging to qualify for loans, credit cards, or favorable interest rates.

By successfully negotiating the removal of these derogatory marks through a pay-for-delete agreement, you can potentially see an improvement in your credit score and overall creditworthiness.

Improving Credit Utilization Ratio

One way in which pay-for-delete letters can positively impact your credit score is by improving your credit utilization ratio. The credit utilization ratio is the amount of credit you are currently using compared to the total amount of credit available to you. By removing negative items from your credit report, your overall debt balance may decrease, leading to a lower credit utilization ratio. This lower ratio can have a positive effect on your credit score and demonstrate responsible credit management to potential lenders.

Enhancing Creditworthiness

Another way in which pay-for-delete letters can affect your credit score is by enhancing your creditworthiness. When negative items are removed from your credit report, lenders may view you as a more reliable borrower who is actively working to address past credit issues. This improved perception of your creditworthiness may increase your chances of qualifying for loans, credit cards, or other financial products with better terms and conditions. By demonstrating a commitment to resolving outstanding debts, you are positioning yourself for greater financial opportunities in the future.

Opening Up Financial Opportunities

By successfully using pay-for-delete letters to remove negative items from your credit report, you are opening up new financial opportunities for yourself. With a higher credit score and improved creditworthiness, you may qualify for loans with lower interest rates, credit cards with higher limits, or other financial products that were previously out of reach. This can lead to cost savings, increased financial flexibility, and a greater sense of financial security. By taking proactive steps to repair your credit, you are paving the way for a brighter financial future.

Key Components Of A Pay-for-Delete Letter

When crafting a pay-for-delete letter, there are several key components that you should include to increase the likelihood of success.

Clear Acknowledgment of Debt

One of the key components of a pay-for-delete letter is a clear acknowledgment of the debt in question. Clearly state the amount owed, the account number, and any relevant details about the debt that will help the recipient identify the account. By acknowledging the debt upfront, you are demonstrating transparency and a willingness to address the issue head-on. This can set a positive tone for the rest of the negotiation process and show that you are serious about resolving the outstanding debt.

Specific Offer for Payment

Another crucial component of a pay-for-delete letter is a specific offer for payment in exchange for the deletion of the negative item from your credit report. Clearly outline the amount you are willing to pay, the method of payment, and any conditions or timelines associated with the offer. By being specific in your payment offer, you are making it easier for the recipient to evaluate the proposal and make an informed decision. This level of detail can help streamline the negotiation process and increase the likelihood of reaching a favorable agreement.

Request for Written Confirmation

It is essential to include a request for written confirmation of the pay-for-delete agreement in your letter. By asking the recipient to provide written confirmation of the agreement, you are creating a record of the negotiation and ensuring that both parties are clear on the terms of the deal. Written confirmation can help protect your rights and provide evidence of the agreement in case of any disputes or misunderstandings down the line. It is a critical component of a pay-for-delete letter that can offer you peace of mind and legal protection during the negotiation process.

Deadline for Response

Setting a deadline for response in your pay-for-delete letter is another important component that can help move the negotiation process forward. By establishing a clear timeline for the recipient to respond to your offer, you are demonstrating a sense of urgency and a commitment to resolving the issue promptly. A deadline can also help you avoid prolonged negotiations or delays in resolving. By setting expectations for a timely response, you are signaling to the recipient that you are serious about addressing the debt and seeking a positive outcome.

How To Write A Pay-for-Delete Letter

Writing a pay-for-delete letter requires careful attention to detail, effective communication skills, and a strategic approach.

Addressing the Recipient

Begin your pay-for-delete letter by addressing the recipient by name. This personalized approach can help establish a rapport with the recipient and show that you have taken the time to address them directly. If you are unsure of the recipient’s name, you can use a generic salutation such as “To Whom It May Concern.” By starting your letter with a polite and respectful greeting, you are setting a positive tone for the rest of the communication.

Stating the Purpose of Your Letter

Clearly state the purpose of your pay-for-delete letter in the opening paragraph. Let the recipient know that you are reaching out to negotiate the removal of a negative item from your credit report in exchange for payment of the outstanding debt. Be direct and upfront about your intentions, as this can help set expectations and guide the recipient towards a resolution. By being transparent about the purpose of your letter, you are demonstrating honesty and a genuine desire to address the issue at hand.

Providing Details About the Debt

Include specific details about the debt in question to help the recipient identify the account and understand the context of your offer. This may include the amount owed, the account number, the original creditor, and any relevant dates or transactions related to the debt. By providing this information upfront, you are making it easier for the recipient to evaluate your offer and make an informed decision. Clarity and specificity can help streamline the negotiation process and increase the likelihood of a positive outcome.

Outlining Your Offer for Payment

Clearly outline your offer for payment in exchange for the deletion of the negative item from your credit report. Specify the amount you are willing to pay, the method of payment, and any conditions or timelines associated with the offer. Be as detailed as possible to ensure that the recipient understands the terms of the agreement and can make an informed decision. By outlining your payment offer clearly, you are demonstrating professionalism and a willingness to work towards a resolution.

Requesting Written Confirmation

Ask the recipient to provide written confirmation of the pay-for-delete agreement in your letter. This written confirmation serves as a record of the negotiation and ensures that both parties are clear on the terms of the deal. Requesting written confirmation can help protect your rights and provide evidence of the agreement in case of any disputes or discrepancies in the future. It is a crucial step in the negotiation process that can offer you peace of mind and legal protection.

Setting a Deadline for Response

Set a deadline for the recipient to respond to your pay-for-delete offer in your letter. By establishing a clear timeline for a response, you are signaling that you are serious about resolving the issue promptly. A deadline can help move the negotiation process forward and prevent delays in resolving. Be specific about the timeframe for a response and indicate the consequences of not meeting the deadline to create a sense of urgency and encourage a timely response.

Keeping a Copy of the Letter

Make sure to keep a copy of your pay-for-delete letter for your records. This copy can serve as a reference point during negotiations and provide documentation of the terms of the agreement. Keeping a record of your communication can help you track the progress of the negotiation, follow up on the agreement, and protect your rights in case of any disputes or misunderstandings. By maintaining a copy of the letter, you are demonstrating diligence and preparedness in your credit repair efforts.

Risks And Limitations Of Pay For Delete Agreements

While pay-for-delete agreements can be an effective strategy for improving your credit score, there are risks and limitations to consider before pursuing this option. Understanding the potential drawbacks and challenges of pay-for-delete agreements can help you make informed decisions and navigate the negotiation process more effectively. It is important to weigh the benefits and risks of pay-for-delete agreements and consider alternative credit repair strategies that may better suit your financial situation.

Inconsistent Acceptance by Creditors

Not all creditors or collection agencies may be willing to enter into pay-for-delete agreements. While some creditors may consider removing negative items from your credit report in exchange for payment, others may adhere to strict policies against such arrangements. The willingness of the creditor to accept a pay-for-delete offer can vary depending on their internal policies, the age of the debt, and the amount owed. It is essential to be prepared for the possibility that your pay-for-delete offer may be declined by certain creditors or collection agencies.

Potential Impact on Credit Score

It is important to consider the potential impact of pay-for-delete agreements on your credit score. While removing negative items from your credit report can improve your credit score, not all credit bureaus may recognize pay-for-delete tactics. Some credit bureaus have policies against the removal of accurate negative information from credit reports, which can limit the effectiveness of pay-for-delete agreements in boosting your credit score. It is crucial to understand the credit reporting policies of the major bureaus and consider how pay-for-delete agreements may impact your credit score in the long term.

Legal Considerations

Before entering into a pay-for-delete agreement, it is essential to consider the legal implications of such arrangements. Pay-for-delete agreements must comply with federal and state laws governing credit reporting and debt collection practices. It is important to ensure that any agreements made are legally binding and enforceable to protect your rights as a consumer. Consulting with a legal professional or credit repair specialist can help you navigate the legal considerations of pay-for-delete agreements and ensure that you are engaging in fair and lawful credit repair practices.

Effectiveness of Pay-for-Delete Tactics

While pay-for-delete agreements can be an effective credit repair strategy, their success may vary depending on the creditor, the age of the debt, and other factors. Not all creditors or collection agencies may be willing to remove negative items from your credit report through pay-for-delete tactics. Additionally, credit bureaus may have policies that restrict the removal of accurate negative information from credit reports, making it more challenging to achieve the desired outcome. It is important to have realistic expectations about the effectiveness of pay-for-delete tactics and consider alternative credit repair strategies if necessary.

What Mistakes Should You Avoid With Pay-for-Delete Letters?

When using pay-for-delete letters to negotiate with creditors or collection agencies, it is essential to avoid common mistakes that can undermine your efforts and hinder the effectiveness of your credit repair strategy. By being aware of these potential pitfalls and taking proactive measures to avoid them, you can increase the likelihood of success in negotiating pay-for-delete agreements and improving your credit score. Here are some common mistakes to avoid when using pay-for-delete letters:

Making Vague Offers for Payment

One common mistake to avoid when writing a pay-for-delete letter is making vague offers for payment. It is essential to be specific and clear about the amount you are willing to pay, the method of payment, and any conditions or timelines associated with the offer. Vague offers can lead to misunderstandings, delays in the negotiation process, and a lack of clarity on the terms of the agreement. By providing detailed and precise payment terms in your pay-for-delete letter, you can increase the likelihood of reaching a favorable agreement with the creditor or collection agency.

Failing to Follow Up on Agreements

Another mistake to avoid is failing to follow up on agreements made through pay-for-delete letters. Once you have reached a pay-for-delete agreement with the creditor or collection agency, it is crucial to follow up on the terms of the agreement and ensure that the negative item is removed from your credit report as promised. Failure to follow up can result in the negative item remaining on your credit report, damaging your credit score and undermining your efforts to repair your credit. By staying proactive and diligent in following up on pay-for-delete agreements, you can maximize the effectiveness of this credit repair strategy.

Not Keeping Accurate Records of Communication

It is important to keep accurate records of all communication related to your pay-for-delete negotiations. This includes copies of your pay-for-delete letter, written confirmation of the agreement, email correspondence, and any other documentation relevant to the negotiation process. Keeping detailed records can help you track the progress of the negotiation, follow up on agreements, and protect your rights in case of disputes or discrepancies. By maintaining accurate records of communication, you are demonstrating diligence and preparedness in your credit repair efforts.

Not Seeking Professional Advice When Needed

One common mistake to avoid is not seeking professional advice when needed during the pay-for-delete negotiation process. If you are unsure about the legal implications of a pay-for-delete agreement, the effectiveness of this credit repair strategy, or how to navigate the negotiation process, it is essential to consult with a qualified legal professional or a reputable credit repair specialist. Seeking professional advice can help you understand your rights as a consumer, navigate the complexities of credit repair, and make informed decisions that align with your financial goals. By seeking professional advice when needed, you can avoid potential pitfalls in the pay-for-delete negotiation process and maximize the effectiveness of your credit repair efforts.

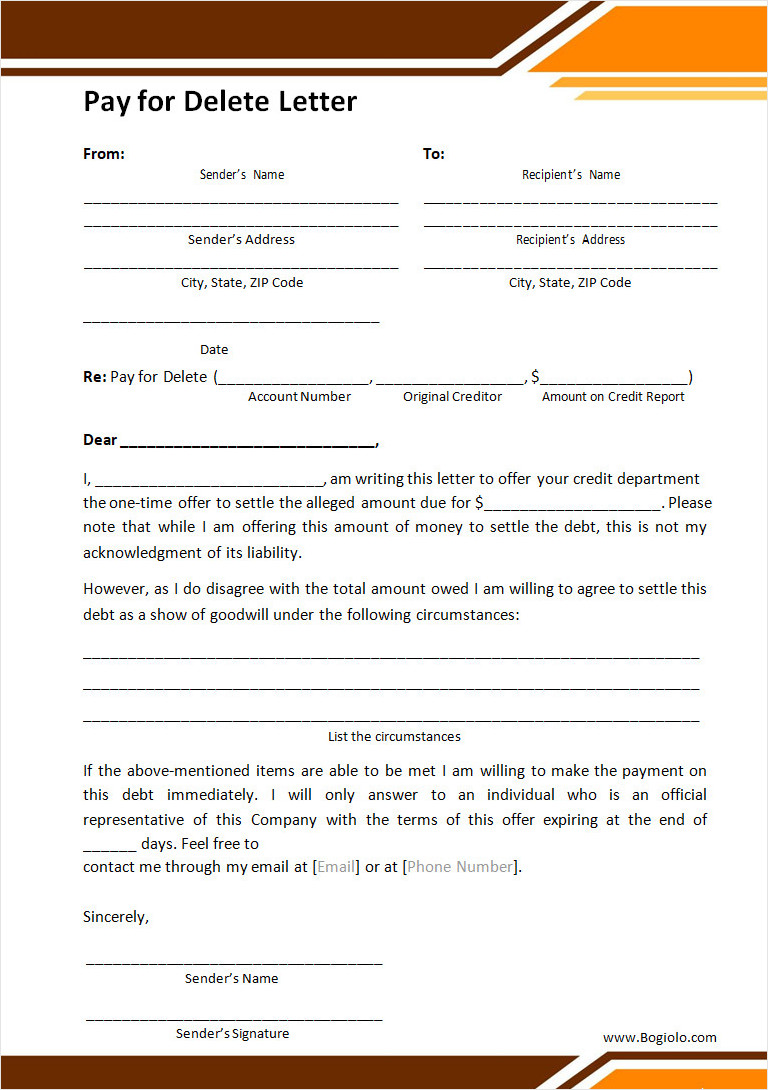

Pay-for-Delete Letter Template

A pay-for-delete letter is a practical tool for negotiating with creditors or collection agencies to remove negative marks from your credit report in exchange for payment. It provides a professional format to communicate clearly and increase your chances of a positive outcome.

To handle credit matters with confidence, use our free pay-for-delete letter template and create effective letters with ease!

Pay for Delete Letter Template – Word