Managing your finances effectively is crucial for securing your financial future and achieving your financial goals. One key tool that can help you gain a deeper understanding of your financial situation is a personal financial statement.

What Is A Personal Financial Statement?

A personal financial statement is a comprehensive document that outlines an individual’s financial position by detailing their assets, liabilities, and net worth.

- Assets include everything you own that has monetary value, such as cash, investments, real estate, and personal belongings.

- Liabilities, on the other hand, are your financial obligations, such as loans, credit card debt, and mortgages.

- Net worth is calculated by subtracting your total liabilities from your total assets, providing a clear picture of your overall financial health.

Why Use A Personal Financial Statement?

Creating a personal financial statement is essential for gaining a holistic view of your finances. By documenting all your assets and liabilities in one place, you can easily assess your financial standing and identify areas for improvement. A personal financial statement can help you:

1. Track Your Progress

One of the key benefits of using a personal financial statement is the ability to track your financial progress over time. By comparing your current statement to previous ones, you can measure how your financial situation has evolved, whether you’ve increased your assets, decreased your liabilities, or maintained a stable net worth. Tracking your progress allows you to celebrate achievements and adjust your financial strategy as needed.

2. Set Realistic Goals

Understanding your financial position through a personal financial statement enables you to set realistic and achievable financial goals. Whether your goal is to save for a down payment on a house, eliminate high-interest debt, or build an emergency fund, having a clear overview of your finances helps you establish specific targets and develop a plan to reach them. Setting realistic goals based on your financial situation increases your chances of success and motivates you to stay on track.

3. Make Informed Decisions

With a personal financial statement at your disposal, you can make more informed decisions about your finances. Whether you’re considering an investment opportunity, planning a major purchase, or evaluating loan options, having a detailed overview of your assets and liabilities allows you to assess the potential impact on your financial health. Making informed decisions based on your financial statement helps you avoid unnecessary risks and align your choices with your long-term financial goals.

4. Monitor Your Debt

Keeping track of your liabilities through a personal financial statement is essential for managing your debt effectively. By documenting all your outstanding loans, credit card balances, and other liabilities, you can monitor your debt levels, track repayment progress, and avoid accumulating excessive debt. Understanding your debt obligations helps you prioritize debt repayment, negotiate better terms with creditors, and ultimately reduce financial stress and improve your overall financial well-being.

When Do You Need A Personal Financial Statement?

A personal financial statement is a valuable tool at various stages of life and financial planning. You may need to create or update your financial statement:

1. Annually

One common practice is to review and update your financial statement annually. By revisiting your financial information each year, you can assess changes in your assets, liabilities, and net worth, as well as make adjustments to your financial goals and strategies. An annual review ensures that your financial statement remains current and aligned with your evolving financial priorities.

2. Before Major Financial Decisions

Before making significant financial decisions, such as buying a home, starting a business, or investing in a large purchase, it’s essential to have an up-to-date personal financial statement. This document provides a comprehensive overview of your financial resources and obligations, enabling you to evaluate the potential impact of the decision on your overall financial health. By reviewing your statement before major financial commitments, you can make well-informed choices that align with your financial objectives.

3. During Life Events

Life events such as getting married, having children, changing careers, or planning for retirement can significantly impact your financial situation. It’s crucial to update your financial statement during these life transitions to reflect any changes in income, expenses, assets, or liabilities. By reassessing your financial position during life events, you can make necessary adjustments to your financial plan, ensure financial stability for your family, and prepare for future milestones.

4. For Financial Planning

Creating a personal financial statement is an essential step in developing a comprehensive financial plan. Whether you’re saving for a specific goal, preparing for retirement, or seeking to improve your financial well-being, a detailed understanding of your current financial status is crucial. By incorporating your financial statement into your financial planning process, you can identify areas for improvement, set achievable objectives, and track your progress towards financial success.

How Do I Write A Personal Financial Statement?

Writing a personal financial statement involves gathering all relevant financial information and organizing it into a clear and concise document. Here are the steps to create your financial statement:

1. Gather Your Financial Information

The first step in writing a personal financial statement is to gather all your financial information in one place. This includes statements for all your bank accounts, investment accounts, retirement accounts, real estate properties, vehicles, and any other assets you own. Additionally, collect statements for any outstanding loans, credit card balances, mortgages, and other liabilities you have.

2. List Your Assets

Once you’ve gathered all your financial information, begin by listing your assets in the personal financial statement. Include all your liquid assets, such as cash, savings accounts, and investment accounts, as well as non-liquid assets like real estate properties, vehicles, and valuable personal belongings. Assign each asset a value based on its current market worth to accurately reflect your total assets.

3. Identify Your Liabilities

Next, identify and list all your liabilities in the personal financial statement. This includes any outstanding loans, credit card debts, mortgages, or other financial obligations you are responsible for. Record the total amount owed for each liability to calculate your total liabilities accurately.

4. Calculate Your Net Worth

After listing your assets and liabilities, calculate your net worth by subtracting your total liabilities from your total assets. The resulting figure represents your net worth, which is an essential indicator of your overall financial health. Monitoring changes in your net worth over time can help you track your financial progress and make informed decisions about managing your finances.

5. Review and Update Regularly

It’s crucial to review and update your financial statement regularly to ensure that it accurately reflects your current financial situation. Schedule periodic reviews, such as quarterly or annually, to track changes in your assets, liabilities, and net worth, and make any necessary adjustments to your financial goals or strategies. By updating your financial statement regularly, you can stay informed about your financial progress, identify areas for improvement, and make informed decisions to achieve your financial objectives.

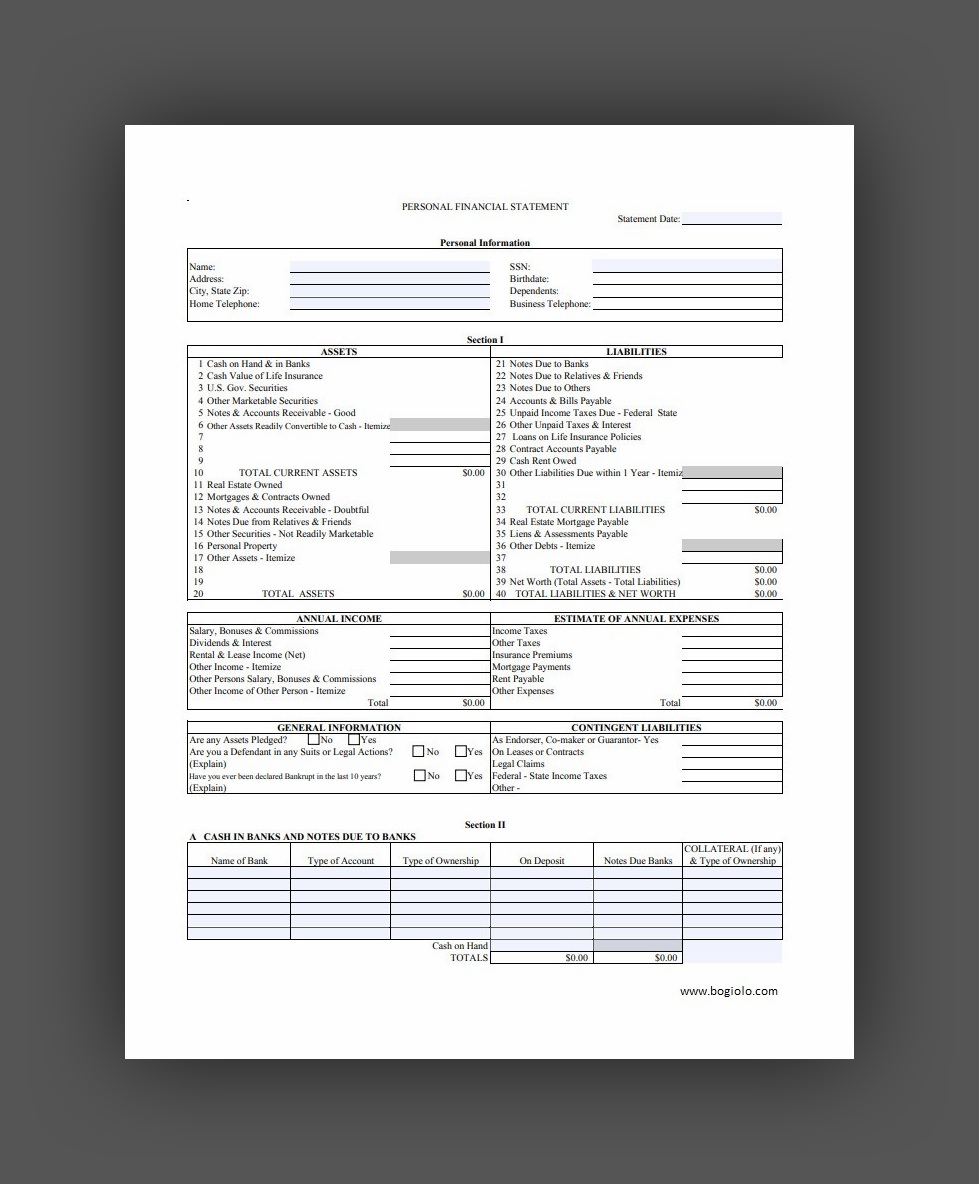

Personal Financial Statement Template

A personal financial statement is essential for understanding your net worth, managing your finances, and preparing for loan applications or investment opportunities. It offers a clear snapshot of your assets, liabilities, and overall financial health.

Download our Free Personal Financial Statement Template today to take control of your financial future. Easy to fill out, customizable, and suitable for individuals, entrepreneurs, or anyone seeking financial clarity.

Personal Financial Statement Template – Download