Understanding your financial health is crucial for effective money management. One way to gain a clear, comprehensive snapshot of your financial situation at a specific point in time is by creating a personal net worth statement.

This statement calculates your net worth by subtracting your liabilities from your assets. It is a powerful tool that not only helps you track your financial progress but is also often required by lenders and financial institutions.

What is a Personal Net Worth Statement?

A personal net worth statement is a document that provides a detailed overview of your financial position. It includes all your assets and liabilities, giving you a clear picture of what you own versus what you owe.

By calculating your net worth, you can see how much you are worth financially at a specific moment in time. This information is valuable for setting financial goals, tracking your progress, and making informed decisions about your money.

What to Include in a Personal Net Worth Statement?

When creating your personal net worth statement, it is important to include the following components:

Assets

Your assets encompass everything you own that has monetary value. This includes cash in bank accounts, investments in stocks and bonds, real estate properties, vehicles, valuable possessions like jewelry or art, retirement accounts, and any other assets that can be converted into cash. It is essential to list all your assets accurately and assign them fair market values.

Liabilities

Liabilities represent your financial obligations and debts that you owe to others. This includes mortgage loans, car loans, credit card balances, student loans, personal loans, medical bills, taxes owed, and any other outstanding debts. It is important to list all your liabilities truthfully and include the exact amounts owed on each debt.

Net Worth Calculation

The heart of your personal net worth statement lies in the calculation of your net worth. This is done by subtracting your total liabilities from your total assets. The resulting figure represents your net worth, which provides a clear indication of your financial standing. A positive net worth signifies a healthy financial position, while a negative net worth indicates that you have more debt than assets.

How to Calculate Your Personal Net Worth

Calculating your net worth is a straightforward process that involves the following steps:

Make a List of Your Assets

Start by compiling a detailed list of all your assets. This includes cash in checking and savings accounts, investment accounts, retirement savings, real estate properties, vehicles, valuable possessions, and any other assets you own. Assign a fair market value to each asset based on current market prices or appraisals.

List Your Liabilities

Next, list down all your liabilities and debts. This should include mortgage loans, car loans, credit card balances, student loans, personal loans, medical bills, taxes owed, and any other outstanding debts. Write down the exact amount owed on each debt to ensure an accurate representation of your liabilities.

Calculate Your Net Worth

Once you have listed all your assets and liabilities, it’s time to calculate your net worth. Subtract the total value of your liabilities from the total value of your assets. The resulting figure is your net worth. This number represents the difference between what you own and what you owe, giving you a clear picture of your financial health.

Tips for Creating a Personal Net Worth Statement

Here are some useful tips to keep in mind when creating your personal net worth statement:

Update Regularly

It’s important to update your net worth statement regularly to reflect any changes in your financial situation. As your assets and liabilities evolve, your net worth will also change. By updating your statement periodically, you can ensure that it accurately reflects your current financial standing.

Include All Assets and Liabilities

Be thorough in listing all your assets and liabilities to ensure an accurate calculation of your net worth. Include every asset you own, no matter how small, and every liability you owe. By capturing all your financial information, you can create a comprehensive net worth statement that provides a true representation of your financial health.

Seek Professional Advice

If you’re unsure about how to create a net worth statement or need help with financial planning, consider seeking advice from a financial advisor. A professional advisor can help you navigate the complexities of personal finance, guide you in setting financial goals, and assist you in creating a personalized financial plan that aligns with your objectives.

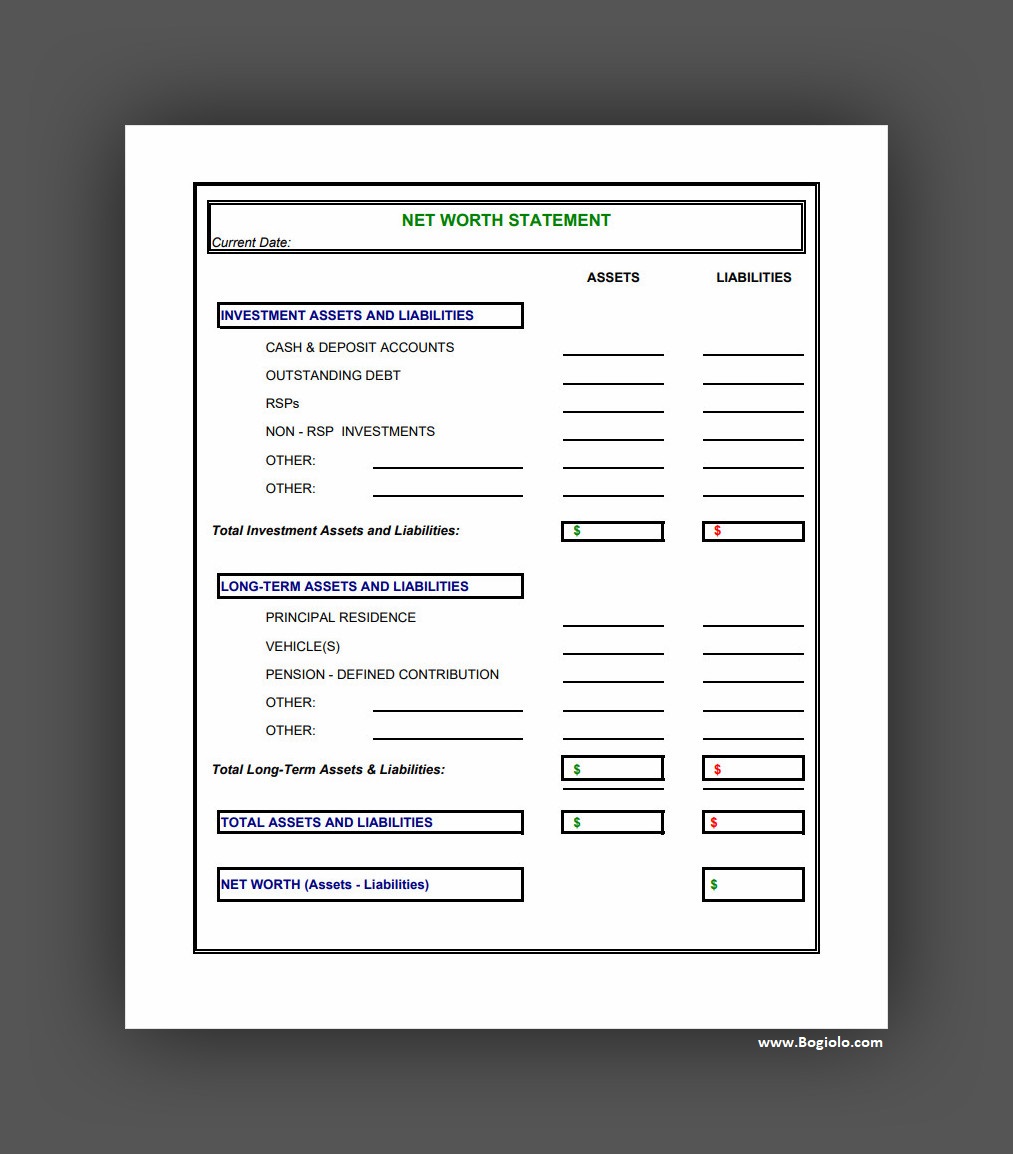

Personal Net Worth Statement Template

In conclusion, a Personal Net Worth Statement Template is a valuable resource for tracking your assets, liabilities, and overall financial health. It gives you a clear picture of where you stand and helps you make informed financial decisions.

Take control of your wealth today—download our Personal Net Worth Statement Template and start building a stronger financial future!

Personal Net Worth Statement Template – DOWNLOAD