What is a Statement of Account?

A statement of account is a crucial document that provides a detailed record of all financial transactions between two parties over a specific period. It serves as a snapshot of the financial relationship between a business and its client, showcasing the services rendered, payments made, and any outstanding balances.

This document serves as a roadmap for both parties to track the flow of money and ensure financial transparency.

Why is a Statement of Account Important?

A statement of account plays a crucial role in fostering transparency, accountability, and trust in financial transactions between businesses and clients. By providing a detailed record of all financial interactions, this document helps to prevent disputes, clarify financial obligations, and prompt timely payments.

The importance of a statement of account can be further understood through its various benefits to both the sender and receiver.

Benefits to the Sender

For the business or service provider sending the statement of account, there are several key benefits that contribute to the efficiency and effectiveness of financial management. Some of the benefits include:

- Financial Clarity: By summarizing all financial transactions, the sender gains a clear overview of the client’s account status, helping them track payments and outstanding balances accurately.

- Improved Communication: Sending regular statements of account fosters open communication with the client, ensuring that both parties are on the same page regarding financial matters.

- Prompt Payment: The statement serves as a reminder for the client to make timely payments, reducing the risk of overdue balances and improving cash flow for the sender.

- Documentation: Keeping detailed records of financial transactions through statements of account helps the sender maintain organized financial documentation for audits and reference.

- Dispute Resolution: In case of any discrepancies or disputes, the statement of account serves as a reference point for resolving issues quickly and efficiently.

Benefits to the Receiver

For the client or recipient of the statement of account, there are also significant benefits that contribute to better financial management and decision-making. Some of the benefits include:

- Financial Awareness: The statement provides a clear summary of all financial interactions, helping the client stay informed about their account status and obligations.

- Budget Planning: By understanding their outstanding balances and payment history, the client can plan their budget effectively and allocate funds for timely payments.

- Verification: Reviewing the statement allows the client to verify the accuracy of invoices, payments, and outstanding balances, ensuring that all transactions are accounted for correctly.

- Payment Reminder: The statement acts as a reminder for any pending payments, prompting the client to take action and settle outstanding balances promptly.

- Financial Transparency: Receiving regular statements of account promotes transparency in the financial relationship between the client and the business, building trust and accountability.

What to Include in a Statement of Account?

Creating a comprehensive statement of account requires careful consideration of the information to be included to ensure clarity, accuracy, and relevance. While the specific details may vary depending on the nature of the business and the financial transactions involved, some essential elements should be included in every statement of account.

Client Information

The first section of a statement of account should provide detailed information about the client, including their name, address, contact information, and any unique identifiers used by the business to identify the client’s account. This information helps to establish the recipient of the statement and ensures that it reaches the intended party.

Invoice Details

The statement should list all invoices generated during the specified period, including unique invoice numbers, dates of issuance, and amounts due for each service provided. Including detailed invoice information helps the client identify the services rendered and correlate them with their payments.

Payment History

A comprehensive payment history is essential for documenting all payments made by the client during the specified period. This section should include the dates of payment, payment methods used, amounts paid for each invoice, and any relevant references or transaction numbers for easy verification.

Outstanding Balances

Clearly stating any outstanding balances owed by the client is crucial for ensuring that the recipient is aware of their financial obligations. This section should detail the total amount outstanding, the invoice numbers related to the balances, the dates when the payments were due, and any applicable late fees or penalties.

Terms and Conditions

Including relevant terms and conditions related to payments, late fees, discounts, and other financial policies helps to set clear expectations for both parties. This section should outline the payment terms, accepted payment methods, deadlines for payments, consequences of late payments, and any other relevant financial policies that may impact the client’s account.

How to Create a Statement of Account

Creating a well-structured and informative statement of account requires attention to detail, accuracy, and clarity to ensure that the document serves its intended purpose effectively. By following a systematic approach and adhering to best practices, businesses can create professional statements of account that meet the needs of both the sender and receiver.

Gather Financial Data

The first step in creating a statement of account is to gather all relevant financial data, including invoices, receipts, payment records, and any other documents related to the financial transactions between the parties. This data forms the foundation of the statement and should be organized systematically for easy reference.

Organize Information

Once the financial data has been collected, it is essential to organize it in a structured format that presents a clear timeline of transactions. Arranging the information chronologically helps the recipient understand the sequence of events and ensures that all transactions are accounted for accurately in the statement.

Include Relevant Details

When creating a statement of account, it is crucial to include all relevant details that provide a comprehensive overview of the financial transactions. This includes invoice numbers, dates of issuance, descriptions of services provided, payment dates, amounts due, and any other pertinent information that helps the recipient understand the nature of the transactions.

Calculate Outstanding Balances

Determining any outstanding balances owed by the client is a critical step in creating a statement of account. By accurately calculating the total amount outstanding, including any late fees or penalties, the sender can provide a clear picture of the client’s financial obligations and prompt them to take action to settle the balances promptly.

Review and Finalize

Before sending out the statement of account, it is essential to review the document for accuracy, completeness, and clarity. The sender should verify that all transactions are correctly recorded, all calculations are accurate, and all details are clearly presented. Once the statement has been reviewed and finalized, it can be distributed to the client for their review and action.

Tips for Sending a Statement of Account

When sending a statement of account to a client, businesses can follow some best practices to ensure

- Be Timely: Send the statement promptly after the end of the billing period to remind the client of any outstanding payments. Timely communication helps maintain a positive relationship and encourages prompt action from the client.

- Use Clear Language: Ensure that the statement is written in clear and concise language that is easy for the client to understand. Avoid using technical jargon or complicated terms that may confuse the recipient.

- Provide Contact Information: Include your contact information in the statement, such as a phone number or email address, so that the client can reach out with any questions or concerns. Being accessible to the client demonstrates professionalism and fosters open communication.

- Follow Up: If the client has not responded or made a payment after sending the statement, follow up with a reminder to prompt action. A gentle reminder can help prevent overdue payments and ensure that the client addresses any outstanding balances promptly.

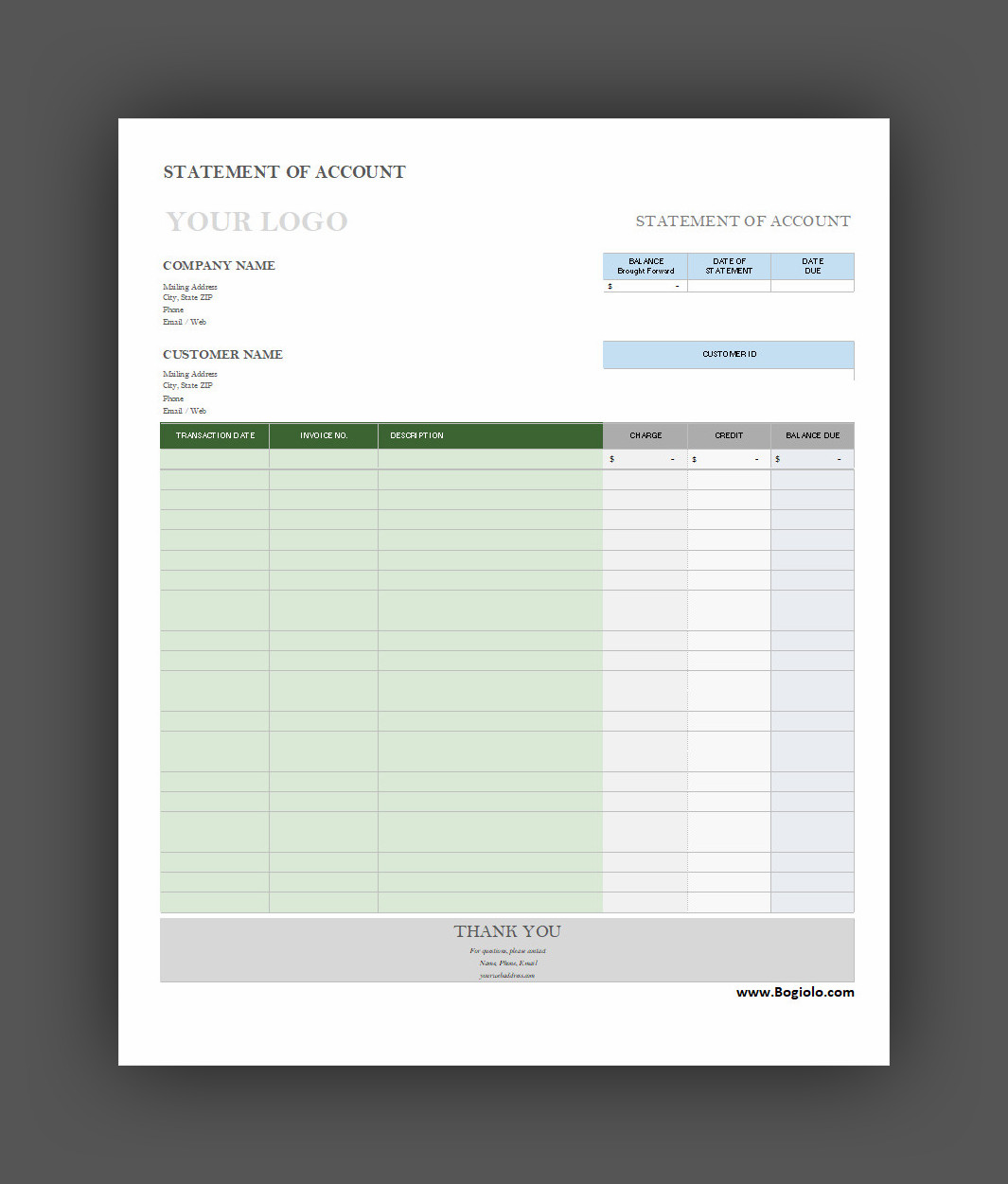

Statement of Account Template

A statement of account is a professional tool for summarizing financial transactions between a business and its clients over a specific period. It provides clarity on balances, payments, and outstanding amounts, ensuring transparency and accuracy.

To keep financial records organized, use our free statement of account template and manage your accounts with ease!

Statement of Account Template – Excel