What is a Financial Agreement?

A financial agreement, also known as a prenuptial agreement or a cohabitation agreement, is a legal contract that outlines how a couple’s assets, liabilities, and other financial resources will be divided in the event of a breakup.

It provides clarity and certainty by establishing clear guidelines for financial matters, helping to avoid disputes and lengthy court proceedings. Financial agreements can be created before, during, or after a relationship and are designed to protect the interests of both parties involved.

Why Should You Consider a Financial Agreement?

There are several compelling reasons why couples should consider creating a financial agreement in their relationship.

Protecting Assets

One of the primary reasons why couples create financial agreements is to protect their assets. This is particularly important for individuals who have significant assets or businesses that they want to safeguard in case of a breakup. By outlining how assets will be divided in the agreement, couples can ensure that each party’s contributions are recognized and protected.

Clarifying Financial Responsibilities

Financial agreements can also help to clarify each party’s financial responsibilities in the relationship. This may include outlining who will be responsible for paying certain debts, managing joint finances, or providing financial support in the event of a breakup. By clearly defining these responsibilities in the agreement, couples can avoid misunderstandings and disputes in the future.

Providing Peace of Mind

Creating a financial agreement can provide peace of mind for both parties in a relationship. Knowing that their financial interests are protected and that there is a clear plan in place for how assets will be divided can reduce anxiety and uncertainty. This can help couples focus on building a strong and healthy relationship, rather than worrying about what might happen if things don’t work out.

Preventing Lengthy and Expensive Court Proceedings

Another important benefit of a financial agreement is that it can help to avoid lengthy and expensive court proceedings in the event of a breakup. By having a clear and legally binding contract in place, couples can streamline the process of dividing assets and liabilities, reducing the need for costly litigation. This can save both time and money, as well as minimize the emotional toll that court proceedings can take.

Protecting Children and Family Members

For couples with children from previous relationships or other family members to consider, a financial agreement can be particularly important. By specifying how assets will be divided and what provisions will be made for children or other dependents, couples can ensure that their loved ones are taken care of in the event of a breakup. This can provide peace of mind and security for all parties involved.

Key Elements of a Financial Agreement

Identification of Assets and Liabilities

One of the key elements of a financial agreement is the identification of all assets and liabilities owned by each party. This may include property, investments, savings, vehicles, businesses, and any other financial resources. By clearly outlining these assets and liabilities, couples can ensure that everything is taken into account when dividing their finances.

Division of Assets

The division of assets is another important element of a financial agreement. This involves specifying how assets will be divided in the event of a breakup, including who will retain ownership of property, investments, and other assets. By establishing clear guidelines for dividing assets, couples can avoid disputes and ensure that each party’s contributions are recognized and respected.

Financial Support

Financial support provisions are often included in a financial agreement to address ongoing financial responsibilities. This may include provisions for spousal maintenance, child support, or other forms of financial assistance in the event of a breakup. By outlining these provisions in the agreement, couples can ensure that everyone’s needs are taken into account and that financial support is provided where necessary.

Termination Clause

A termination clause is a crucial element of a financial agreement that outlines the conditions under which the agreement can be terminated or amended. This may include events such as the birth of a child, a change in financial circumstances, or the end of the relationship. By including a termination clause, couples can ensure that the agreement remains relevant and enforceable in changing circumstances.

Legal Advice

One of the most important elements of a financial agreement is the requirement for both parties to seek independent legal advice before agreeing. This ensures that each party fully understands their rights and obligations under the agreement and provides an additional layer of protection. Legal advice can help to ensure that the agreement is fair, reasonable, and legally binding.

How to Create a Financial Agreement

Initial Discussion and Planning

The first step in creating a financial agreement is to have an open and honest discussion with your partner about your financial situation and goals. This may involve discussing your assets, liabilities, income, expenses, and any other relevant financial information. It is important to be transparent and forthcoming during this initial discussion to ensure that both parties have a clear understanding of the financial landscape.

Seeking Legal Advice

Once you have had an initial discussion with your partner, the next step is to seek independent legal advice from a solicitor who specializes in family law. A solicitor can help you understand the legal implications of a financial agreement, ensure that the agreement complies with all legal requirements, and provide guidance on how to protect your interests. Both parties must seek independent legal advice to ensure that the agreement is fair, reasonable, and legally binding.

Drafting the Agreement

With the help of your solicitor, you can begin drafting the financial agreement. This involves outlining all relevant financial information, assets, liabilities, and any other provisions that you wish to include in the agreement. Your solicitor can help you navigate the legal requirements and ensure that the agreement accurately reflects your intentions and protects your interests. It is essential to be thorough and detailed when drafting the agreement to avoid any ambiguity or misunderstandings.

Review and Sign the Agreement

Once the agreement has been drafted, it should be reviewed by both parties and their respective solicitors. It is important to ensure that both parties fully understand and agree to the terms of the agreement before signing. Any necessary revisions should be made at this stage to ensure that the agreement accurately reflects your intentions. Once both parties are satisfied with the agreement, it can be signed and become legally binding.

Tips for Successful Financial Agreements

1. Be Transparent

Disclose all relevant financial information and assets to avoid disputes in the future. Transparency is key to creating a fair and equitable financial agreement that protects the interests of both parties.

2. Seek Legal Advice

Consult with a solicitor who specializes in family law to ensure that the agreement is legally binding and enforceable. Legal advice can help you understand your rights and obligations and protect your interests.

3. Review Regularly

Periodically review and update your financial agreement to reflect any changes in your financial circumstances or relationship status. Regular reviews can help ensure that the agreement remains relevant and valid.

4. Communicate Openly

Keep the lines of communication open with your partner and be willing to discuss any concerns or issues that may arise. Effective communication is essential to the success of a financial agreement.

5. Consider Mediation

If you are unable to reach an agreement on certain financial matters, consider seeking the assistance of a mediator. Mediation can help facilitate negotiations and constructively resolve conflicts.

6. Plan for the Future

When creating a financial agreement, consider your future needs and goals, including retirement savings, investments, and children’s education. Planning for the future can help ensure that your financial interests are protected in the long term.

7. Be Flexible

Be prepared to adapt and amend your financial agreement as needed. Circumstances can change, and it is important to be flexible and willing to revisit the agreement to ensure that it remains relevant and effective.

8. Prioritize Fairness

Aim to create a financial agreement that is fair and equitable to both parties. Consider each party’s contributions, needs, and expectations to ensure that the agreement reflects a balanced and reasonable division of assets and liabilities.

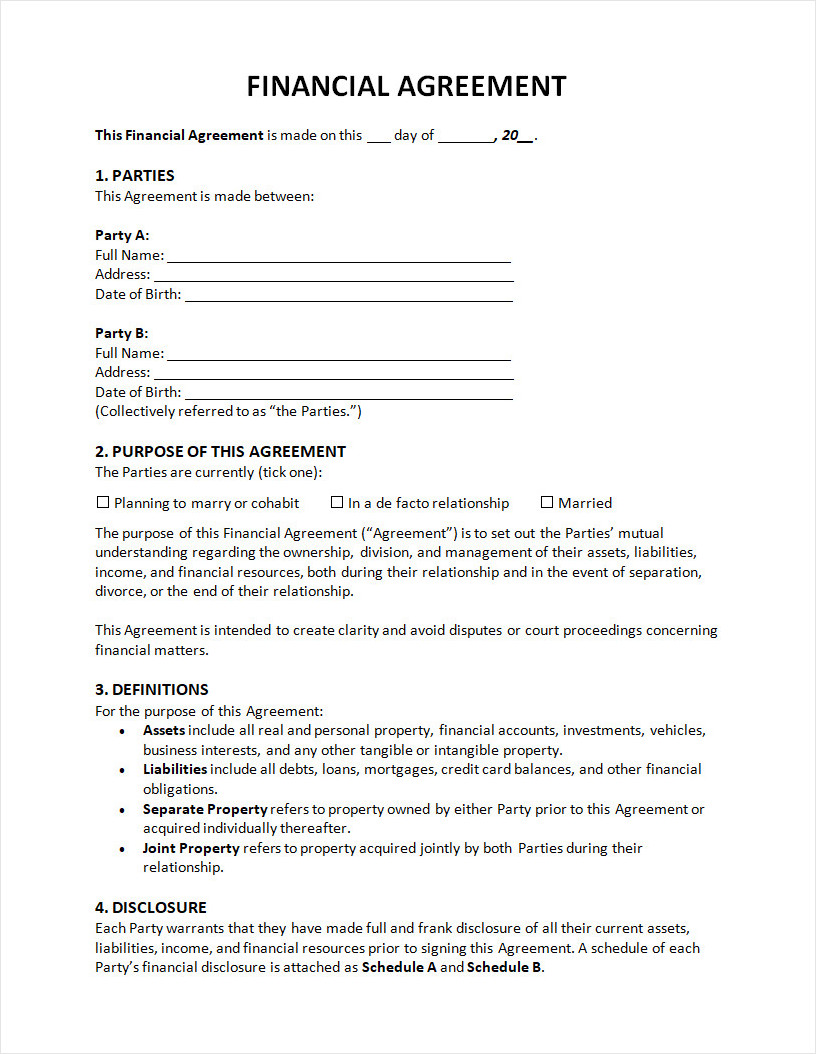

Financial Agreement Template

A financial agreement is a formal document that outlines how two or more parties will manage, share, or divide financial responsibilities and assets. It helps ensure clarity, fairness, and legal protection by specifying payment terms, obligations, and dispute resolution procedures. Ideal for couples, business partners, or individuals entering financial arrangements, this template promotes transparency and trust.

Download and use our free financial agreement template today to create a clear, legally sound agreement that protects everyone’s financial interests.

Financial Agreement Template – Word