In today’s fast-paced business world, employees frequently use their personal vehicles for work-related travel. Whether it’s driving to client meetings, running errands, or attending conferences, these miles can quickly add up. To ensure that employees are fairly compensated for these expenses, many companies use mileage reimbursement forms.

These forms serve as a structured document for employees to formally request compensation for the costs associated with using their personal vehicles for business-related travel. They ensure that both the employer and employee have a clear, documented record of the miles driven, the business purpose of each trip, and the calculated reimbursement amount, which covers expenses such as fuel, wear and tear, and maintenance.

What is a Mileage Reimbursement Form?

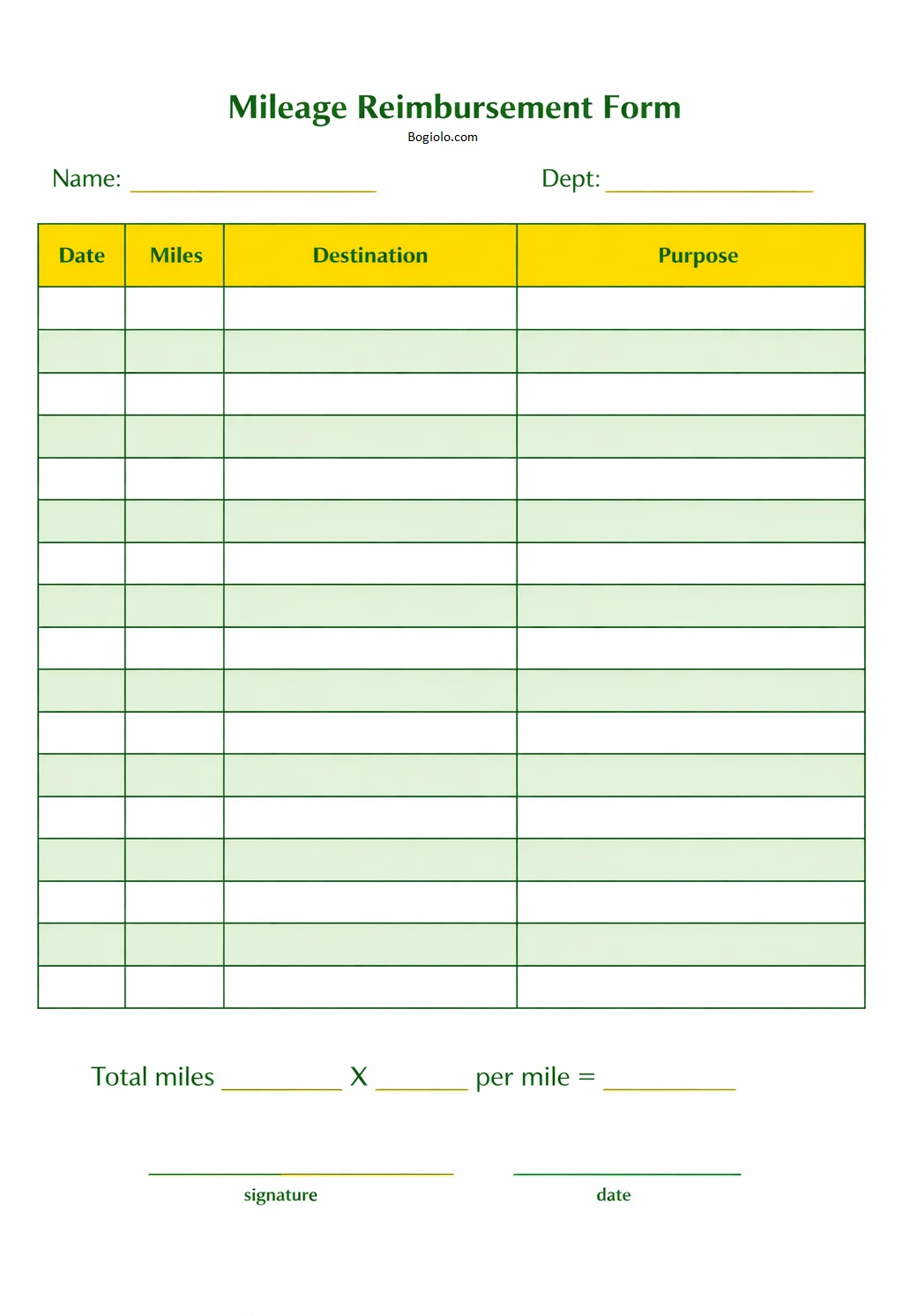

A mileage reimbursement form is a document used by employees to request reimbursement for the costs associated with using their personal vehicles for work-related travel. It typically includes fields for the date of the trip, the starting and ending locations, the purpose of the trip, the total miles driven, and the calculated reimbursement amount.

This form helps both the employee and employer track and document business-related mileage, ensuring that employees are fairly compensated for their expenses.

Purpose of the Mileage Reimbursement Form

The primary purpose of a mileage reimbursement form is to provide a structured way for employees to request compensation for the costs incurred while using their personal vehicles for business-related travel.

By documenting each trip, including the purpose and mileage driven, the form ensures that both the employee and employer have an accurate record of the expenses. This helps prevent any disputes or misunderstandings regarding reimbursement amounts and ensures that employees are fairly compensated for their travel expenses.

Why is a Mileage Claim Important?

A mileage claim is essential for both employees and employers for several reasons.

Ensures Fair Compensation

Filing a mileage claim ensures that employees are fairly compensated for their travel expenses. By documenting each trip and calculating the reimbursement amount accurately, employees can ensure that they are not out of pocket for using their personal vehicles for work-related travel. This fair compensation is essential for maintaining employee satisfaction and motivation in carrying out business-related tasks.

Supports Compliance

Mileage claims support compliance with tax regulations and internal policies regarding business-related travel expenses. By accurately documenting mileage and expenses, employees and employers can demonstrate compliance with tax laws and company guidelines. This documentation is crucial for audits and regulatory requirements, ensuring that all expenses are accounted for and handled appropriately.

Facilitates Expense Tracking

Using mileage claims facilitates expense tracking for both employees and employers. By recording each business-related trip and associated costs, employees can monitor their travel expenses and ensure they are reimbursed accordingly. Employers can use this information to track overall travel expenditures, analyze trends, and make informed decisions about budget allocations and reimbursement policies.

Improves Financial Planning

The use of mileage claims can improve financial planning for companies by providing visibility into travel expenses and patterns. By analyzing data from mileage claims, employers can identify cost-saving opportunities, optimize travel routes, and adjust reimbursement rates as needed. This proactive approach to financial planning can help organizations allocate resources more efficiently and reduce unnecessary expenses related to business travel.

Reduces Disputes

Mileage claims help reduce disputes related to travel expenses by providing a clear and documented record of each business-related trip. Employees can easily reference their mileage claims to verify the accuracy of their reimbursement amounts, while employers have a transparent basis for calculating compensation. This reduces the likelihood of misunderstandings or disagreements regarding travel expenses, promoting a harmonious working relationship between employees and employers.

Key Components of the Mileage Reimbursement Form

A typical mileage reimbursement form includes several key components to ensure that all necessary information is captured for each business-related trip. These components may vary depending on the company’s specific requirements, but some common elements include:

Date of the Trip

The date of the trip is a crucial piece of information included in a mileage reimbursement form. This component helps track when the travel occurred, allowing both employees and employers to identify specific trips and associated expenses accurately. Recording the date also ensures that reimbursements are processed promptly and aligned with the corresponding business activities.

Starting and Ending Locations

The starting and ending locations of a business-related trip are essential components of a mileage reimbursement form. By recording these details, employees can track the distance traveled, while employers can verify the relevance of the trip to work responsibilities. This information helps calculate the total miles driven and determine the appropriate reimbursement amount based on the company’s mileage rate.

Purpose of the Trip

Including a section for the trip on a mileage reimbursement form is crucial for justifying the need for reimbursement. Employees are typically required to provide a brief description of why the trip was necessary for business purposes. This information helps employers assess the validity of the travel expense and ensures that reimbursements are allocated appropriately.

Total Miles Driven

Recording the total miles driven during a business-related trip is a fundamental component of the mileage reimbursement form. This information is used to calculate the reimbursement amount owed to the employee based on the distance traveled. Accurately tracking the total miles driven ensures that employees are compensated fairly for the wear and tear on their personal vehicles and the fuel costs incurred during work-related travel. It also provides a clear record of the business-related mileage for tax purposes and expense tracking.

Reimbursement Amount

The reimbursement amount section of a mileage reimbursement form calculates the total compensation owed to the employee for using their personal vehicle for business-related travel. This amount is typically based on the total miles driven, the company’s mileage rate, and any additional expenses incurred during the trip. Providing a detailed breakdown of the reimbursement amount helps employees understand how the compensation was calculated and ensures transparency in the reimbursement process.

Policies and Guidelines

Some mileage reimbursement forms may include a section outlining the company’s policies and guidelines related to business travel expenses. This section provides employees with information on the company’s reimbursement rates, approved expenses, and any specific rules or requirements for submitting mileage claims. By including this information on the form, employees can adhere to the company’s guidelines and ensure that their reimbursement requests align with company policies.

Employee Signature

Many mileage reimbursement forms require the employee to sign and date the form to certify the accuracy of the information provided. By signing the form, the employee acknowledges that the details of the trip, including the mileage driven and expenses incurred, are valid. This signature serves as a confirmation that the employee is requesting reimbursement in accordance with the company’s policies and guidelines.

Manager Approval

In some organizations, a manager’s approval may be required on the mileage reimbursement form before processing the reimbursement. The manager’s approval indicates that the business-related trip was necessary and aligns with the company’s objectives. By obtaining manager approval, companies can ensure that travel expenses are authorized and meet the organization’s standards for reimbursement.

Documentation Attachments

Employees may be asked to attach relevant documentation to the mileage reimbursement form, such as receipts for fuel purchases or parking fees. These attachments provide additional proof of the expenses incurred during the business-related trip and help validate the reimbursement request. Including documentation attachments ensures that all expenses are accurately accounted for and supported by evidence.

How to Fill Out a Mileage Claim Form

Filling out a mileage claim form is a straightforward process, but it’s essential to ensure that all necessary information is included to avoid any delays or disputes. Here is a step-by-step guide on how to fill out a mileage claim form:

Step 1: Enter the Date of the Trip

Start by entering the date of the trip on the form. Make sure to include the day, month, and year to accurately document when the business-related travel occurred.

Step 2: Fill in the Starting and Ending Locations

Provide the starting location (e.g., office or home) and the ending location (e.g., client’s site or conference venue) of the trip. Include specific addresses or landmarks to ensure clarity.

Step 3: Describe the Purpose of the Trip

Briefly describe the purpose of the trip, such as attending a client meeting, conducting site visits, or attending a training session. This information helps justify the need for reimbursement.

Step 4: Calculate the Total Miles Driven

Use a mileage tracker or online mapping tools to determine the total miles driven during the trip. Record this figure accurately on the mileage claim form.

Step 5: Determine the Reimbursement Amount

Based on the total miles driven and the company’s mileage rate, calculate the reimbursement amount owed to you. Consider any additional expenses incurred during the trip, such as tolls or parking fees.

Step 6: Submit the Completed Form for Processing

Once you have filled out all the necessary information on the mileage claim form, sign and date the form to certify its accuracy. If required, obtain your manager’s approval before submitting the form to the designated department for processing.

Conclusion

Mileage reimbursement forms are essential tools for tracking and compensating employees for business-related travel expenses. By documenting each trip’s details, including the purpose, mileage driven, and expenses incurred, these forms ensure fair compensation and compliance with tax regulations.

Employers benefit from having a clear record of business-related mileage and expenses, enabling better budget planning and financial management. By understanding the key components of a mileage reimbursement form and following a step-by-step guide to filling out a mileage claim form, employees can streamline the reimbursement process and ensure accurate compensation for their travel expenses.

Mileage Reimbursement Form Template – DOWNLOAD