Do you have a great deal of exchanges to make? On the off chance that truly, at that point you may frequently run out of checks, right? At the point when you pay with different checks each day, you additionally need to keep a record of it. On the off chance that you likewise have a great deal of checks, to such an extent that they regularly drop out from your cabinet, a checkbook register can be perhaps the most ideal approaches to keep every one of them at one spot, disposing of the odds of losing them. This is the reason numerous individuals frequently incline toward internet banking as opposed to making exchanges through checks.

Yet, imagine a scenario where you need to see a particular check’s record however the bank’s site is down or isn’t working appropriately. Here comes the benefit of keeping a checkbook register. You can check your records any time you need, which can be helpful. You can get to your records whenever in light of the fact that the checkbook register is accessible all day, every day. Guarantee to expound on every single check in your checkbook register; else, it won’t satisfy the center reason.

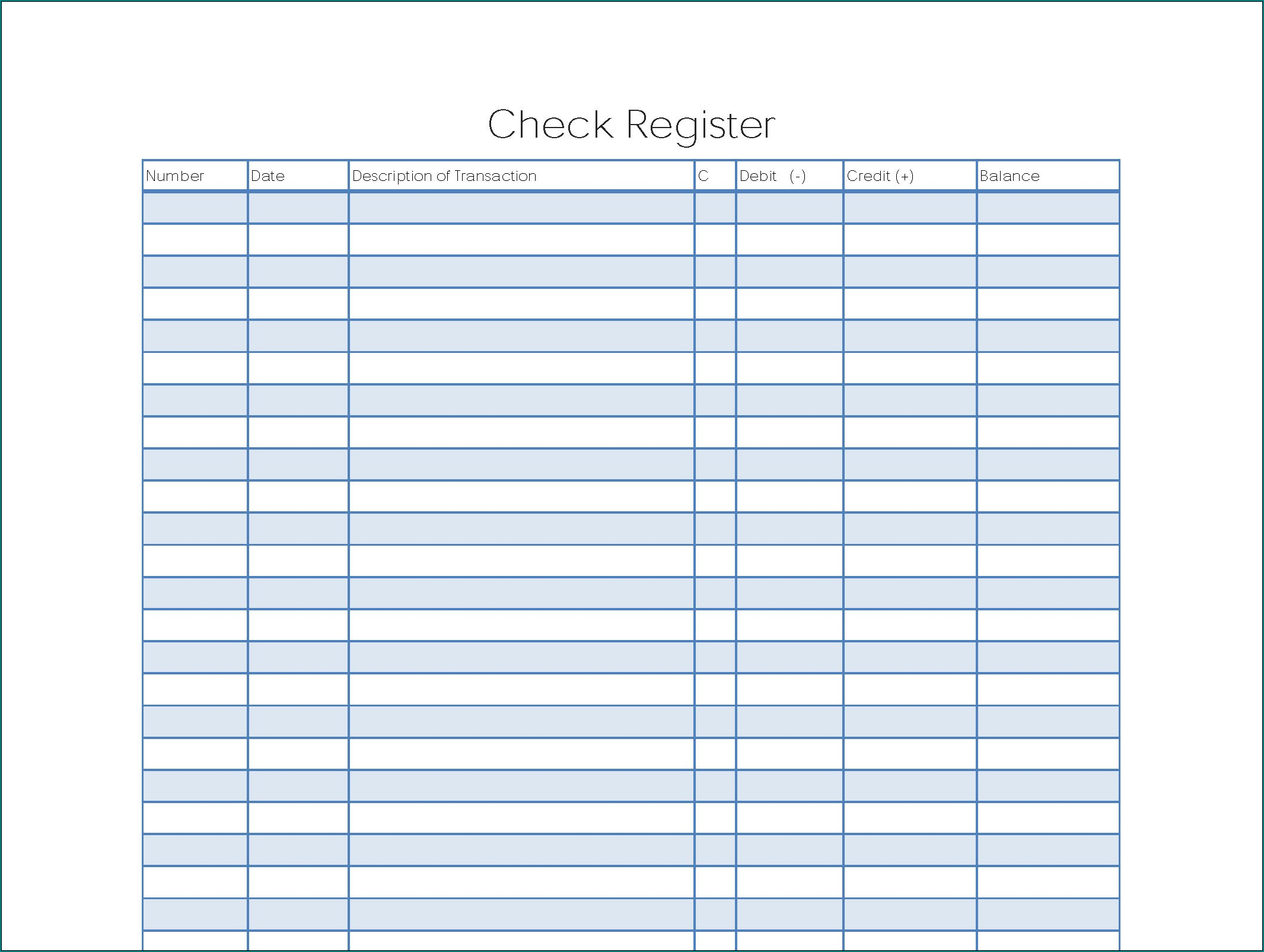

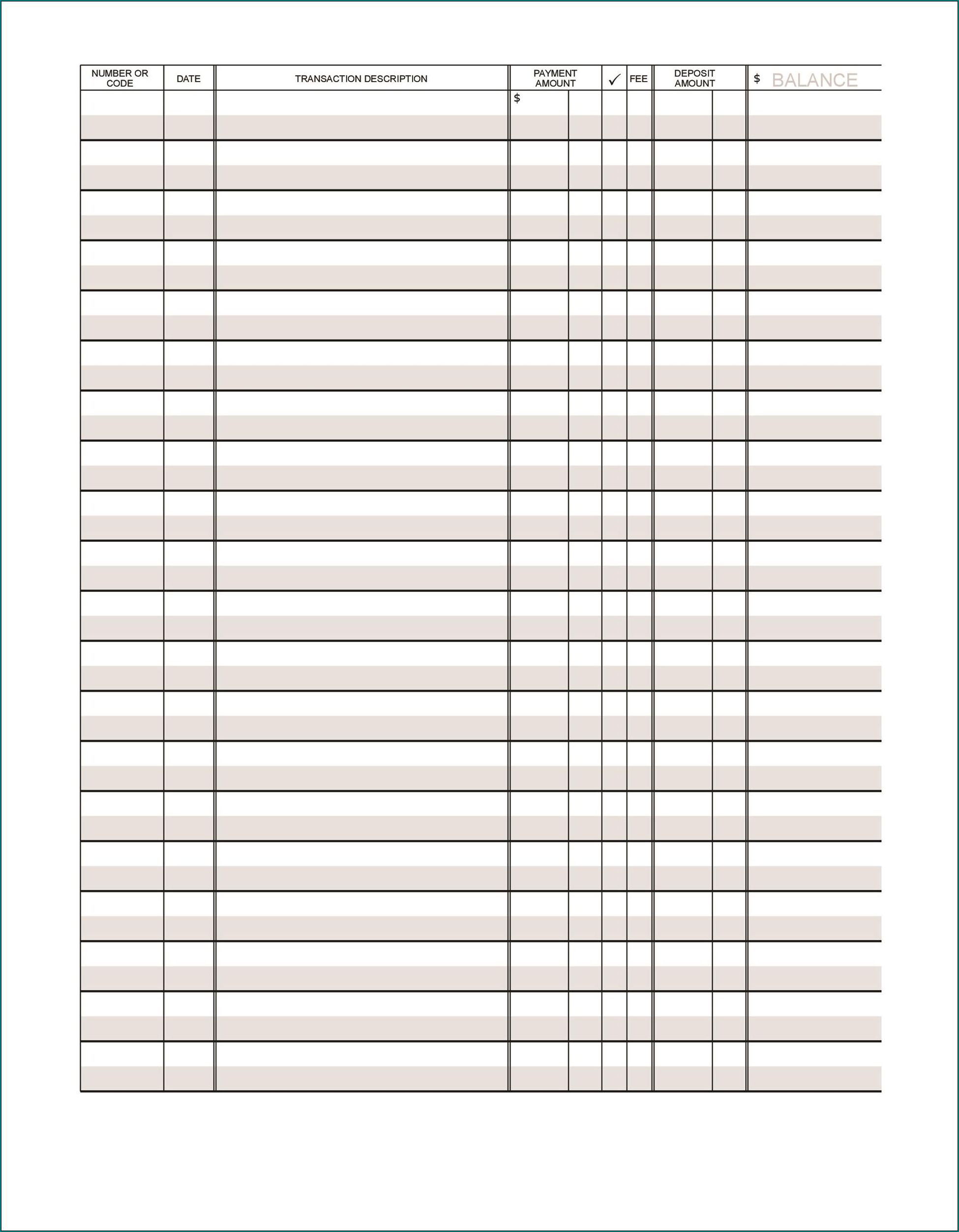

A checkbook register is a casual record of stores and withdrawals to and from your record. It is otherwise called a Check Register. It gives a thorough record, all things considered, and charges that you have produced using your ledger. The assertion held by the bank, a record of every single essential withdrawal and stores from and to your checking account, is known as the bank articulation.

Check registers are something contrary to that. This is an unpleasant register where you record every one of your exchanges done through checks for individual record-keeping in the event that you need to match and cross-check your checkbook register and bank articulation. Likewise, a checkbook register can prove to be useful when your bank’s site is down or you don’t have web access.

A check register incorporates the responsible dates, account names utilized, check numbers, acknowledges and charges related for the record, exchange portrayals, and so forth Check registers are utilized prior to posting anything in the overall record. Regularly, there are comparable records found in this register. It relies on the kind of exchanges and the individuals you are managing. For example, if an entrepreneur manages a few retailers, a check register would have their name and comparative depiction in the register.

Normally, a check register causes you decide the equilibrium in your checking account. On the off chance that people keep a check register, they can see the payment and a wide range of exchanges related with the record. On the off chance that the check register is for a corporate business, the board can likewise utilize it to assess how much money has been dispensed by the organization and can monitor incomes. Organizations and people can see their check register and settle on essential choices too as it features the genuine image of consumptions and speculations.

When you compose a check, you need to record it in the check register. Pretty much every check register is the equivalent and has comparative titles. Check the basic titles that a check register has.

Check Number

This is the number that is appeared on the right-hand side of the check. In certain checks, it is likewise on the base. Typically, checks are in sequential request. This is the reason there is no damage, regardless of whether you commit an error or a mistake. You can just compose the check number and ensure that you are not missing any check.

Date

This is the day you compose the check. You need to ensure that you compose the right date as the individual for whom you are composing it may not get it the sum in their bank store if something goes wrong.

Depiction of the Transaction

This is the portrayal that decides to whom the check was given. You can name it in any capacity. For the most part, pick the depiction of the exchange with the name of the individual. For example, on the off chance that you are managing a retailer for your business, notice their name in the depiction.

Installment Amount

This is the measure of installment that you compose on the check. You need to remember the specific installment for the segment. Whether or not you made the installment utilizing your check card, Mastercard or through internet banking implies, you need to guarantee that the installment careful sum goes in this part.

Withdrawal Amount

This is the measure of cash that you took out from the bank because of any explanation. You need to guarantee to compose the total and careful sum.

Charge Amount

This is the expenses that may have been caused during the exchange. For example, on the off chance that you have taken out cash from the ATM, you will be charged some additional cash as administration charges. This is the sum that is neither related with the bank nor the exchange. You need to ensure that you compose the expense sum in this check register segment.

Store Amount

This is the cash that you have stored into your checking account.

Move

In the event that you have two records and under any circumstances, you are needed to move the sum starting with one record then onto the next, you need to compose this sum in the check register.

Samples of Check Register Template :

Equilibrium

This is quite possibly the main areas in the check register. This is the adjusting segment which depends on the exchange you made. Contingent on the exchange, you either need to add or take away the sum from the past equilibrium for it to coordinate with your present equilibrium. For example, envision you purchased something for $300 from a retailer and paid them with a money order. You had $500 in your financial balance. You need to guarantee that you effectively take away (on the off chance that you take cash out) or add (in the event that you put cash into your record).

Check Register Template | Word download