When applying for a mortgage, it’s crucial to provide all the necessary documentation to support your financial history and current situation. However, there may be instances where certain aspects of your application raise concerns for the lender. This is where a Mortgage Letter of Explanation (LOE) comes in.

A LOE allows you to clarify any details that might be viewed as red flags by the lender, ensuring they have a complete understanding of your financial background before deciding on your loan application.

What is a Letter of Explanation?

A Letter of Explanation, commonly referred to as an LOE, is a document that allows borrowers to provide additional context or details about specific aspects of their financial history that may be concerning to the lender. It serves as a tool for borrowers to explain any discrepancies or red flags that appear on their mortgage application.

The primary purpose of a Letter of Explanation is to allow borrowers to provide a full picture of their financial situation to the lender. By offering explanations for any potential concerns, such as gaps in employment, late payments, or large credit inquiries, borrowers can mitigate any negative perceptions and increase their chances of loan approval.

Why Do You Need a Letter of Explanation for a Mortgage?

Enhancing Loan Approval Chances

One of the main reasons why a Letter of Explanation is necessary when applying for a mortgage is that it can significantly enhance your chances of loan approval. Lenders want to ensure that borrowers are financially responsible and capable of making timely mortgage payments. By providing a detailed explanation for any potential red flags, borrowers can reassure lenders of their creditworthiness.

Addressing Red Flags

Red flags on a mortgage application, such as gaps in employment, late payments, or high levels of debt, can trigger concerns for lenders. A Letter of Explanation allows borrowers to address these red flags directly, providing context and mitigating any negative assumptions that may arise from the initial review of the application.

Establishing Transparency

Transparency is key in the mortgage application process. By submitting a Letter of Explanation, borrowers demonstrate their willingness to be open and honest about their financial history. This transparency can go a long way in building trust with the lender and showcasing the borrower’s commitment to fulfilling their financial obligations.

What to Include In a Letter of Explanation?

Clear and Detailed Explanation

When composing a Letter of Explanation for your mortgage application, it is crucial to provide a clear and detailed explanation for any discrepancies or red flags. Clearly outline the reasons behind the issues in question and provide supporting evidence to strengthen your case.

Supporting Documentation

Supporting documentation is essential when crafting a Letter of Explanation. Attach relevant documents, such as pay stubs, bank statements, or letters from employers, that substantiate the information provided in your explanation. This additional evidence can reinforce the credibility of your explanation.

Accountability and Resolution

Take accountability for any mistakes or oversights in your financial history and explain how you have addressed or plan to address them. Lenders appreciate borrowers who take responsibility for their actions and demonstrate a proactive approach to resolving any issues that may have arisen.

Future Prevention Strategies

In your Letter of Explanation, it is beneficial to outline any steps you have taken or intend to take to prevent similar issues from occurring in the future. By demonstrating your commitment to improving your financial management practices, you show lenders that you are actively working towards maintaining a healthy financial profile.

Expressing Gratitude

Conclude your Letter of Explanation by expressing gratitude to the lender for considering your application. A sincere expression of thanks can leave a positive impression and convey your appreciation for the opportunity to provide additional context to support your mortgage application.

How to Write a Letter of Explanation for a Mortgage

Honesty and Transparency

When writing a Letter of Explanation, honesty and transparency are paramount. Be truthful in your explanation and provide all relevant details without embellishment or omission. Lenders value transparency and authenticity in the information provided by borrowers.

Clarity and Concise

Ensure that your Letter of Explanation is clear, concise, and to the point. Avoid unnecessary details or explanations that may distract from the main purpose of the letter. Present your information to make it easy for the lender to understand.

Professional Tone

Maintain a professional tone throughout your Letter of Explanation. Use formal language and structure your explanation in a business-like manner. A professional tone conveys seriousness and respect for the lender, underscoring your commitment to the mortgage application process.

Thorough Proofreading

Before submitting your Letter of Explanation, be sure to thoroughly proofread the document for any errors or inconsistencies. Check for spelling and grammar mistakes, as well as any inaccuracies in the information provided. A well-proofread letter reflects attention to detail and professionalism.

What To Do If Your Letter of Explanation is Rejected?

Request Feedback

If your Letter of Explanation is rejected by the lender, consider requesting feedback on why it was not accepted. Understanding the reasons for rejection can help you make necessary revisions or improvements to strengthen your explanation and increase the likelihood of approval.

Revise and Resubmit

Based on the feedback received, revise your Letter of Explanation accordingly. Address any shortcomings or areas of concern highlighted by the lender and make the necessary adjustments to enhance the clarity and effectiveness of your explanation. Once revised, resubmit the letter for reconsideration.

Seek Professional Assistance

If you are struggling to craft an effective Letter of Explanation or are unsure how to address the lender’s concerns, consider seeking assistance from a mortgage advisor or counselor. These professionals can provide guidance and support in creating a compelling explanation that aligns with the lender’s requirements.

Be Persistent and Patient

Securing a mortgage approval can be a lengthy and sometimes challenging process. Remain persistent and patient throughout the application process, especially if your initial Letter of Explanation is rejected. Continue to engage with the lender, make necessary revisions, and demonstrate your commitment to addressing any concerns raised.

Explore Alternative Options

If, despite your best efforts, your Letter of Explanation is repeatedly rejected, it may be worthwhile to explore alternative mortgage options or lenders. Different lenders have varying criteria and requirements, so another lender may be more receptive to your explanation and offer a favorable loan approval.

Stay Positive and Proactive

Keep a positive mindset and stay proactive in your approach to addressing any challenges that arise during the mortgage application process. By maintaining a positive attitude and taking proactive steps to improve your application, you can increase your chances of securing the mortgage approval you seek.

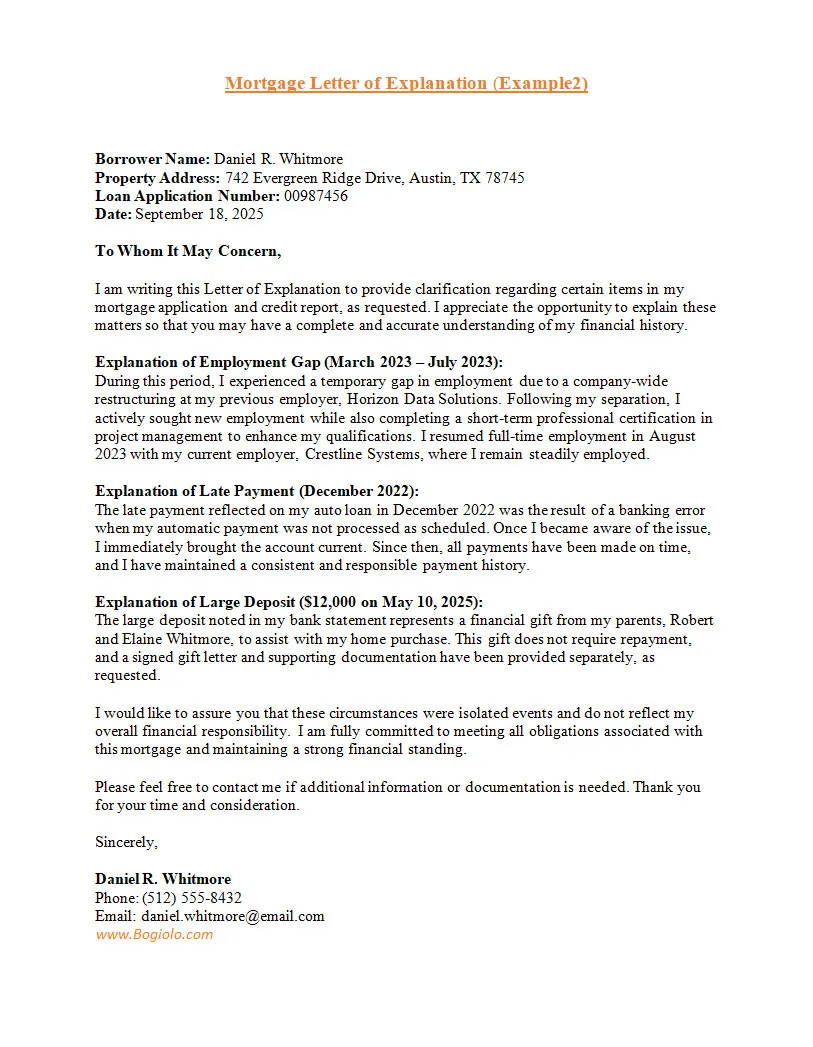

Mortgage Letter of Explanation Template

A Mortgage Letter of Explanation helps borrowers clearly and professionally explain specific financial situations or irregularities—such as credit inquiries, employment gaps, late payments, or large deposits—to lenders. It provides a structured format to present facts honestly and concisely, helping lenders better understand your circumstances and evaluate your application accurately. With a well-prepared template, you can reduce confusion, support your mortgage application, and move forward with confidence.

Download our Mortgage Letter of Explanation Template today to clearly address lender questions and strengthen your mortgage application.

Mortgage Letter of Explanation Template – WORD