In today’s fast-paced world, managing personal finances can be a daunting task. With so many financial decisions to make, from budgeting and saving to investing and retirement planning, it’s easy to feel overwhelmed. This is where a personal financial planner comes in.

What Is a Financial Planner?

A financial planner is a professional who helps individuals and families create a plan to meet their financial goals. They work with clients to develop strategies for budgeting, saving, investing, and retirement planning.

Financial planners take into account a client’s financial situation, goals, and risk tolerance to create a personalized financial plan. They help clients make informed decisions about their money and provide ongoing support to help them stay on track.

The Importance of Personal Financial Planning

1. Financial Security and Stability

One of the key benefits of personal financial planning is the ability to achieve financial security and stability. By creating a comprehensive financial plan, individuals can identify potential risks and develop strategies to mitigate them. This can help protect against unexpected expenses, job loss, or other financial setbacks. Financial planning provides a sense of security and peace of mind, knowing that there is a plan in place to address any financial challenges that may arise.

2. Goal Achievement

Personal financial planning is crucial for setting and achieving financial goals. Whether it’s saving for a down payment on a home, funding a child’s education, or retiring comfortably, a well-developed financial plan can help individuals track their progress and stay focused on their goals. Financial planners work with clients to establish realistic and achievable goals, create a plan to reach them, and adjust the plan as needed based on changing circumstances.

3. Wealth Preservation

Another important aspect of personal financial planning is wealth preservation. By working with a financial planner, individuals can develop strategies to protect and grow their wealth over time. This may involve investing in diversified portfolios, minimizing taxes, and planning for the transfer of assets to future generations. Financial planners can help clients make informed decisions to preserve and build wealth for themselves and their families.

What Do Financial Planners Do?

Financial planners offer a wide range of services to help clients manage their finances effectively. Some of the key services provided by financial planners include:

1. Financial Goal Setting

Financial planners help clients identify their short-term and long-term financial goals and develop a plan to achieve them. This may involve setting specific targets for savings, investments, and debt reduction. By creating a roadmap for achieving their goals, clients can stay motivated and focused on their financial objectives.

2. Investment Management

Financial planners help clients create an investment portfolio that aligns with their goals and risk tolerance. This may involve selecting appropriate investments based on the client’s time horizon, risk appetite, and financial objectives. Financial planners monitor the performance of investments and make adjustments as needed to ensure the portfolio remains on track to meet the client’s goals.

3. Retirement Planning

One of the most important services provided by financial planners is retirement planning. Financial planners help clients prepare for retirement by developing a plan to save and invest for the future. This may involve calculating retirement income needs, maximizing contributions to retirement accounts, and developing a withdrawal strategy in retirement. Financial planners help clients navigate complex retirement decisions to ensure they can retire comfortably.

4. Tax Planning

Financial planners help clients minimize their tax liability and take advantage of tax-saving opportunities. This may involve optimizing deductions, credits, and tax-deferred investment accounts to reduce taxes owed. By working with a financial planner, clients can develop a tax-efficient strategy to maximize their after-tax income and preserve wealth over time.

5. Estate Planning

Financial planners help clients create a plan for the distribution of their assets after death. This may involve drafting wills, trusts, and powers of attorney to ensure that assets are transferred according to the client’s wishes. Estate planning also involves minimizing estate taxes and probate costs to preserve assets for beneficiaries. Financial planners work with clients to create a comprehensive estate plan that addresses their unique needs and goals.

6. Risk Management

Financial planners help clients protect their financial assets through insurance and other risk management strategies. This may involve identifying potential risks, such as disability, illness, or premature death, and developing a plan to mitigate these risks. Financial planners help clients select the appropriate insurance coverage, such as life insurance, health insurance, and disability insurance, to protect against financial loss and provide financial security for themselves and their families.

Types of Financial Planners

Different types of financial planners specialize in various areas of personal finance. Some common types of financial planners include:

1. Certified Financial Planner (CFP)

CFPs are professionals who have completed extensive training and education in financial planning. They are required to adhere to strict ethical standards and are well-versed in all aspects of personal finance. CFPs work with clients to develop comprehensive financial plans that align with their goals and values.

2. Chartered Financial Consultant (ChFC)

ChFCs are professionals who have expertise in insurance, investments, and estate planning. They help clients create comprehensive financial plans to achieve their goals. ChFCs work with clients to develop strategies for protecting and growing wealth over time, taking into account their unique financial circumstances and objectives.

3. Registered Investment Advisor (RIA)

RIAs are professionals who provide investment advice and manage portfolios for clients. They are held to a fiduciary standard, meaning they must act in the best interests of their clients. RIAs work with clients to develop customized investment strategies that align with their goals, risk tolerance, and time horizon.

Smart Finance Management Tips to Avoid Wasteful Spending

In addition to working with a personal financial planner, there are several strategies individuals can use to manage their finances effectively and avoid wasteful spending. Some smart finance management tips include:

1. Create a Budget

One of the most important steps in managing personal finances is creating a budget. A budget helps individuals track their income and expenses, identify areas where they can save money, and set financial goals. By creating a budget and sticking to it, individuals can avoid overspending and ensure they are living within their means.

2. Automate Savings

Automating savings is a simple yet effective way to grow wealth over time. By setting up automatic transfers to a savings account or retirement account, individuals can ensure they are consistently saving money without having to think about it. Automating savings helps build a financial cushion for emergencies, retirement, or other financial goals.

3. Avoid High-Interest Debt

High-interest debt, such as credit card debt, can quickly accumulate and become a burden on finances. To avoid wasteful spending on interest payments, individuals should prioritize paying off high-interest debt as quickly as possible. By reducing debt, individuals can free up more money for savings, investments, and other financial goals.

4. Review Your Investments

Regularly reviewing investment portfolios is essential for long-term financial success. Individuals should assess the performance of their investments, review asset allocation, and make adjustments as needed to stay on track with their financial goals. By staying informed about investment performance and market trends, individuals can make informed decisions about their investment strategy.

5. Plan for Emergencies

Building an emergency fund is crucial for financial security. An emergency fund helps individuals cover unexpected expenses, such as medical bills, car repairs, or job loss, without having to go into debt. By setting aside three to six months’ worth of living expenses in an emergency fund, individuals can protect against financial setbacks and ensure they have a financial safety net.

6. Stay Informed

Staying informed about financial news and trends is essential for making informed decisions about money. Individuals should regularly read financial publications, follow reputable sources for financial information, and stay up-to-date on market developments. By staying informed, individuals can make educated decisions about their finances, such as when to buy or sell investments, how to optimize tax strategies, and when to adjust their financial plan based on changing circumstances.

7. Seek Professional Advice

While managing personal finances independently is possible, seeking professional advice from a personal financial planner can provide valuable insights and expertise. A financial planner can offer personalized guidance on budgeting, saving, investing, and retirement planning based on an individual’s unique financial situation and goals. By working with a financial planner, individuals can benefit from a comprehensive financial plan tailored to their needs and objectives.

8. Track Your Progress

Tracking financial progress is essential for staying on target with financial goals. Individuals should regularly review their financial plan, track income and expenses, monitor investment performance, and adjust the plan as needed. By keeping tabs on financial progress, individuals can identify areas for improvement, celebrate achievements, and stay motivated to reach their financial goals.

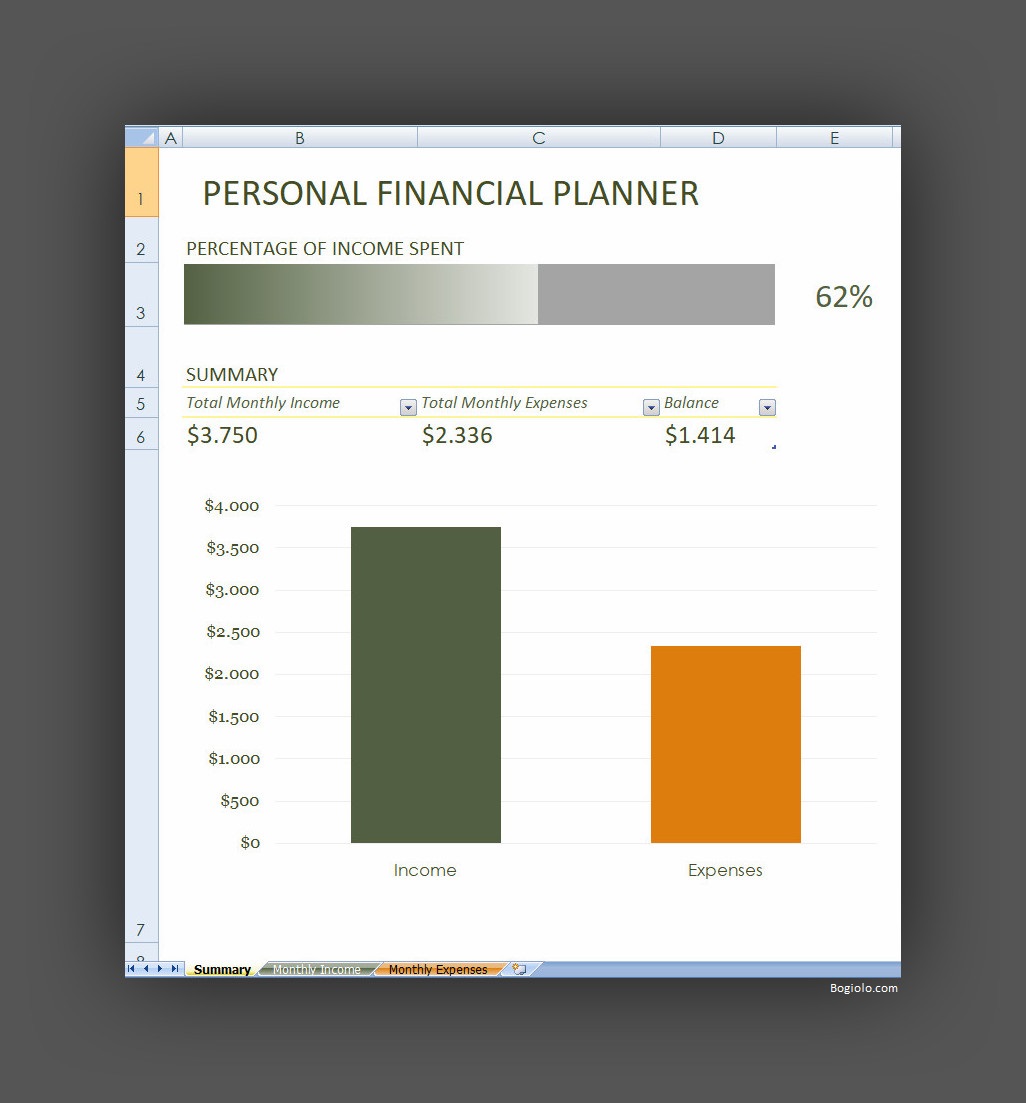

Personal Financial Planner Template

Start using our free personal financial planner template today to take control of your finances, track your spending, and build a secure financial future.

Personal Financial Planner Template – Download