In the event you are a business owner which makes your money providing good or companies to other business, you will most probably desire to reward your good customers and make order-placing much easier on them by extending credit rating. Let’s encounter it; businesss are inclined to spend extra every time they use a line of credit open to them. So it only helps make perception you could develop your business and maximize your profits by giving a credit history program on your consumers. This will likely make it possible for them to purchase items or services currently, and pay out for them at a later day. As a way to carry out this, you’ll would like to add a credit history application form on your toolbox of enterprise templates. We’ve some in your case to download on this site.

If you’re a company that does do the job with people, extending credit is still an option in your case. The risk that arrives with extending credit rating right to people is way greater, so you will must use a credit rating application form and credit rating check for making a call. Smaller vendors make up for this possibility by charging larger interest fees. In case your shoppers generally make smaller purchases, it could not be considered a good notion to extend any credit history. However, if you’re a non-public caterer who assists affluent folks strategy their functions, you may find that extending credit history may help you grow your business. A credit rating software form will help protected the credit rating you lengthen by making sure that your consumers have got a secure monitor history of honoring their money owed.

Why Should I Extend Credit history Using a Credit Software Form?

Not sure you are all set to extend credit rating? Consider it using this method; you’re most likely already doing it. Every time your business accepts credit card payments, checks or simply sends invoices to consumers, you’re primarily extending credit rating. You take these payment forms about the assumption that customers can have the funds to pay to the transaction. The only variation is the fact that when you are accepting credit rating card payments, your merchant account provider shoulders the risk. Whenever you prolong credit history via invoices or checks, nevertheless, the chance is transferred to you. You’re the a person answerable for verifying and accepting payments and handling the dangers that include them.

Some industries, like development businesss or makers, typically prolong credit by invoicing. Invoices are generally owing internet 30 days, or thirty times from receipt.

Considered one of the main factors businesss give credit rating should be to support purchaser target much less on costs and even more on their own wants. Getting a credit history possibility can help you make extra profits and boosts your romance along with your consumer.

It is essential to notice that extending credit rating will cost you dollars if it is completed incorrectly. Once you sell anything on credit, you won’t have fast reimbursement and you’ll should quickly make up for the expense, which generally means borrowing funds movement from other regions of your running money.

And if a little something transpires plus your clients are not able to pay, you could finish up paying revenue on asformment action as well as other highly-priced measures to try to recoup your losses.

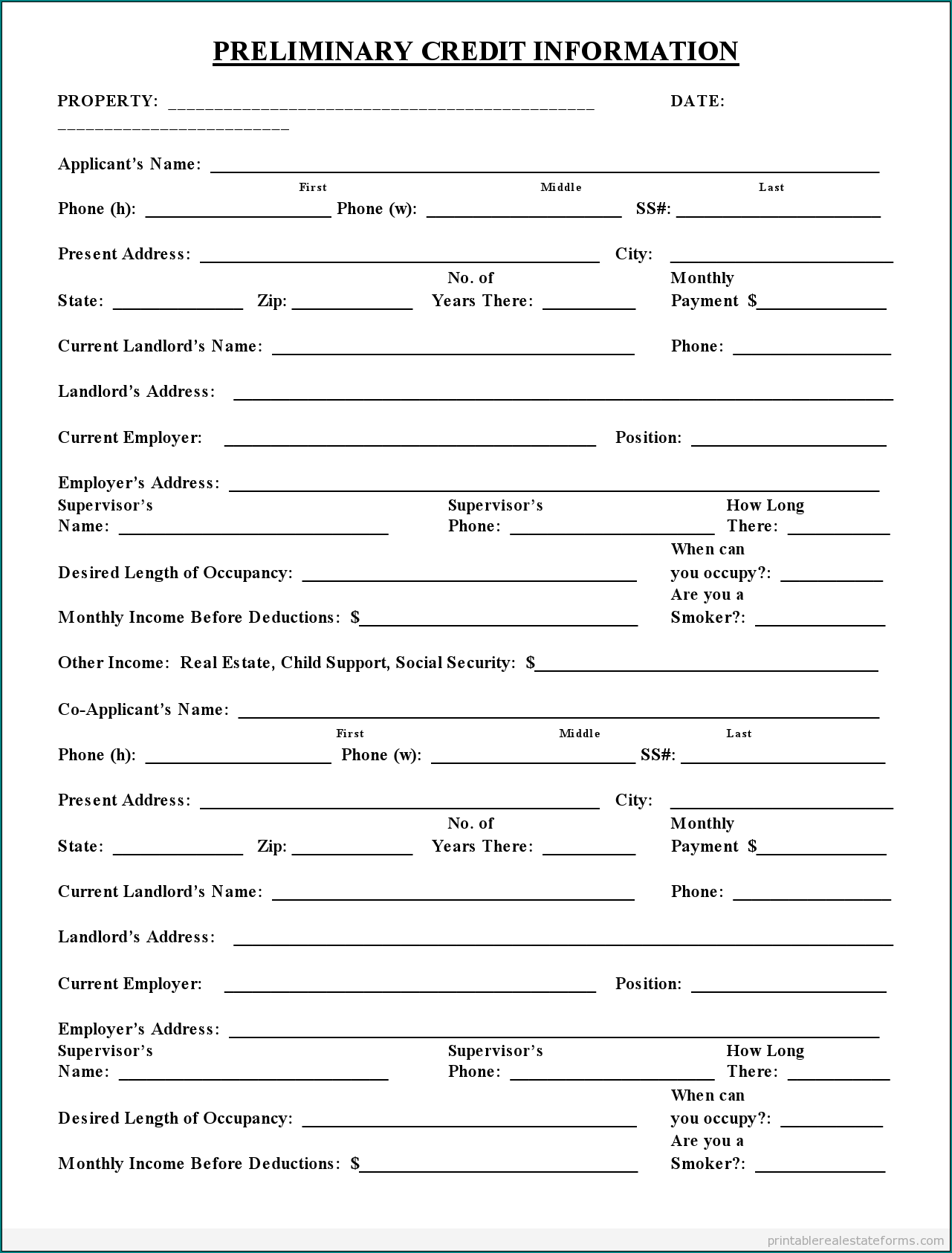

Samples of Business Credit Application Form :

Prior to handing out a credit rating form to your entire massive clients, make sure that you have a legit business rationale to extend credit. Assess the hazards of getting many of your respective greater buyer default. If a fiscal disaster takes place, will you manage to continue to be afloat devoid of counting your excellent invoices as profits? In the event you can not shoulder much danger, it may well not be the correct the perfect time to increase credit on your shoppers. It is best to be capable to prolong credit rating devoid of turning into overly reliant on it for profits. In other words, your income move is your cash stream, and exceptional invoices might or might not be paid out. Will it harm your dollars circulation to increase credit history which will not be paid again? If that’s the case, it may not be the appropriate time for you to present credit possibilities in your purchaser foundation.

Business Credit Application Form | Word download