A commercial credit application is otherwise called the commercial credit extension or business credit, is a measure of cash gave by a bank to an organization which is pre-endorsed and that can be taken by the getting organization whenever to help meet the different monetary commitments of the business. Commercial credit is regularly used to subsidize normal everyday activities of the business and is frequently taken care of to the bank once supports become accessible when a business makes benefits.

In the event that you are an entrepreneur that brings in your cash giving great or administrations to other business, you’ll no doubt need to remunerate your great clients. Let’s be honest; organizations will in general spend more when they have a credit extension open to them.

Some time before you offer credit to your clients, you’ll need to choose how you will oversee credit accounts. You’ll have to know whether you can charge late expenses (and the amount you can charge) just as assortment laws in your general vicinity.

Now, you’ll need to talk with an attorney to comprehend the strategies and techniques that are set up in your state with regards to broadening credit. Buyer security laws fluctuate generally, and there’s a great deal of space for blunder. To maintain these laws, you’ll need to make a uniform cycle for broadening credit and unmistakably map out your strategies. Here are a few things to note:

Who are your optimal clients? Will you offer credit to people, or organizations?

What organization will you use to run credit checks your clients when they apply for credit?

What are your installment strategies? When will bills be expected? What installment choices will you offer?

Who will your clients with credit plans contact when they have an inquiry?

By what means will you receipt your clients?

Will you re-appropriate any of these errands to another organization?

Have you built up a security strategy for ensuring customer information?

In what capacity will you protect touchy monetary information?

What’s our blueprint for gathering late or delinquent record installments?

What different contemplations do you need to evaluate to agree to nearby laws?

Utilizing these inquiries, you can make a firm credit strategy that plots everything from financing costs to techniques when a client flaws. Your clients ought to get a duplicate of these things via the post office once per year and be told of changes. For the most part, this is classified “Terms and Conditions” and they can change as indicated by the neighborhood just as government laws. Your terms and conditions ought to contain all legitimate information, debate goal systems, and information on what happens when you should put a record in assortments.

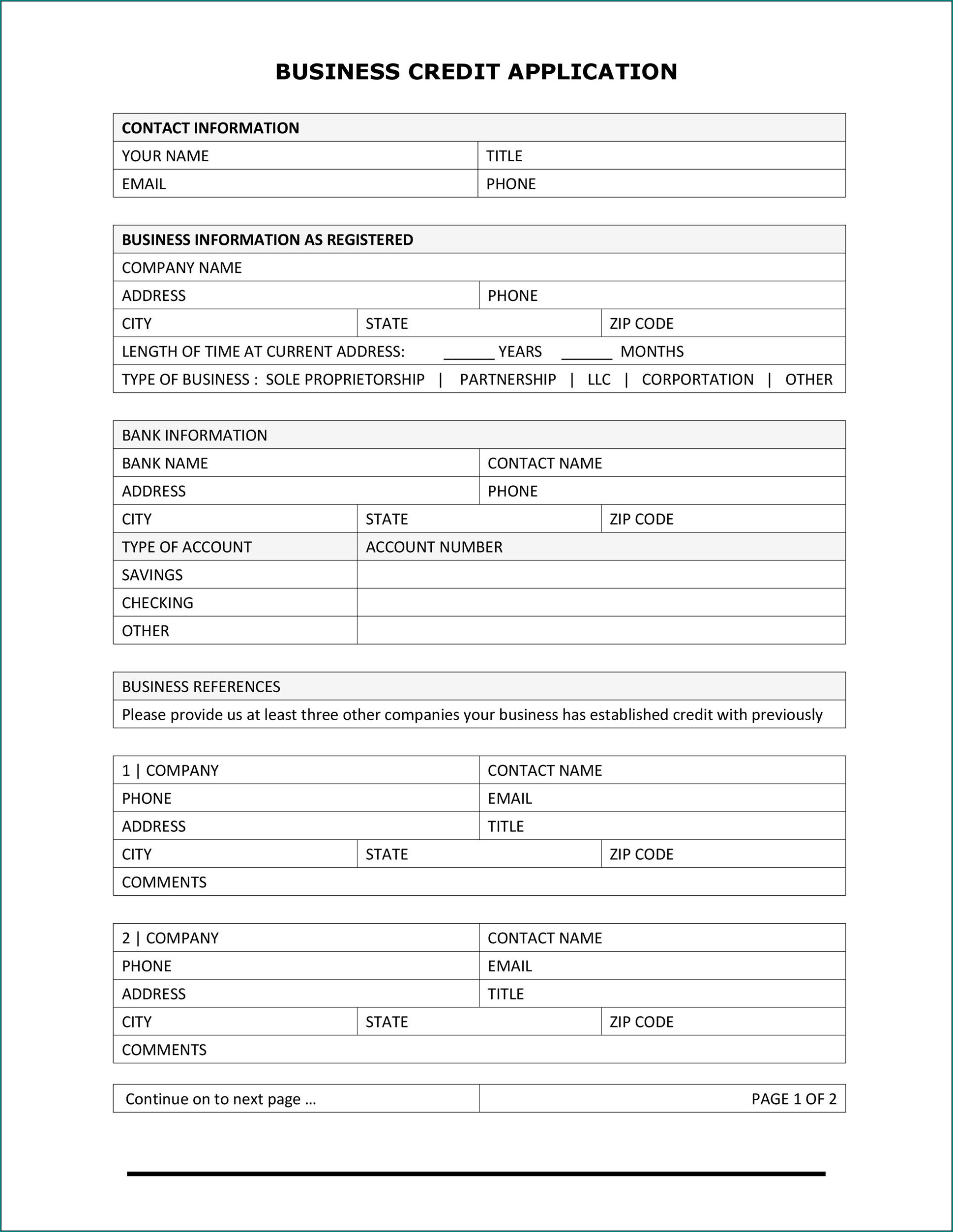

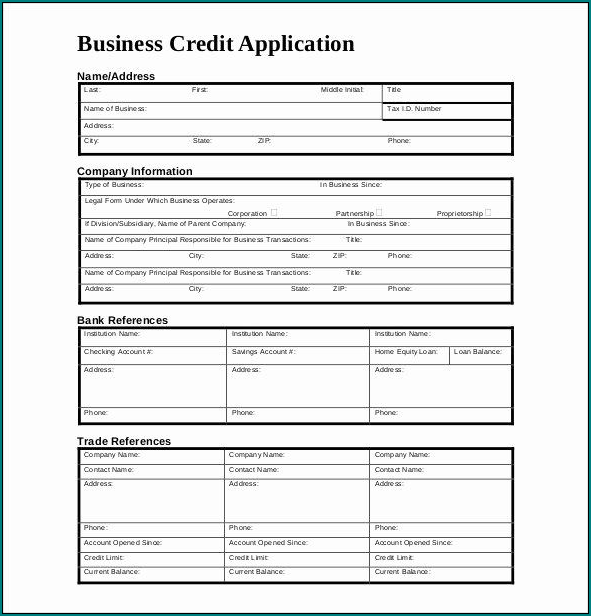

Other information that you will require on your credit application layout:

Pay confirmation: For people, this implies that you’ll need charge archives, bank proclamations, or the quantity of the HR office to affirm subtleties of business. For organizations, you may request a benefit and misfortune proclamation, bank articulations, charge reports, or other information that shows their ordinary benefit.

References: You should request monetary references. For buyers applying for credit, this implies banks, credit accounts, and so on For organizations applying for credit, this implies sellers and whatever other creditors that they may have.

Addresses: Addresses that an individual has inhabited in the previous two years are a significant piece of pulling a credit report. You’ll need to understand what states, districts, and towns the individual has lived in so you can pull a precise credit report. For a business, you’ll need the entirety of the addresses the organization works together at.

Contact Phone Numbers: For people, this will be their wireless, home telephone, and work telephone number. For organizations, you’ll need to get information on who is answerable for paying solicitations.

Assessment ID and other recognizing information: For people, this is their federal retirement aide number. For organizations, you’ll need their expense ID and business ID.

Foundation information, resources: For people, you’ll need the names of their last two businesses, work dates, and any insurance, for example, value in a home. For managers, you’ll need to understand what sort of value they can offer, and how long they’ve been doing business, and may even demand reinforcement reports, for example, a duplicate of the marketable strategy.

Mark: This is significant. Try not to handle a credit application without a mark giving consent for you to pull a credit report.

Samples of Commercial Credit Application Form :

Individual Guarantees: Some people will have someone with a superior credit record co-sign their credit application forms. That is fine, however you’ll need to get all the information for this person, too, ideally on another application form.

Commercial Credit Application Form | Word download