To keep the records of all the petty cash of the company for small expenditures, you can create a petty cash reconciliation report that can help you to document all the expenditures related to the petty cash.

Petty cash is cash on hand that is kept by a business to pay for minor expenses that do not require a cheque issuance. These minor expenses are taxi fares, transportation fares, postage, payment for lunch meetings, payment for needed office supplies, etc. Businesses must keep a petty cash fund at all times so that the business can immediately have money to spend on their little needs.

What Is Petty Cash Reconciliation?

Petty cash reconciliation is the process of reviewing petty cash records. It is done to determine if the sum of the total amount on the petty cash register and the total remaining cash is equivalent to the kept petty cash fund. Reconciliation is usually done before the petty cash funds are refilled or at regular intervals. By conducting petty cash reconciliation, a business can ensure proper handling and recording of petty cash funds.

Undocumented disbursement is a common problem with petty cash. That is because not all custodians are accountants, so it’s possible that they may have incorrectly entered the disbursement details. There is also a high risk of fraud whenever there is cash, and it is another reason for doing petty cash reconciliation. Conducting petty cash reconciliation is like doing an internal audit, where you do not notify the custodian that you will be reviewing the petty cash register. This way, you can detect any personal withdrawals made by the custodian.

Steps for Effective Petty Cash Reconciliation

Step 1: Deduce the Mentioned Balance

Understand the petty cash management policy of your company and then review the balance stated, whether they are matching or not.

Step 2: Prepare the reconciliation Form

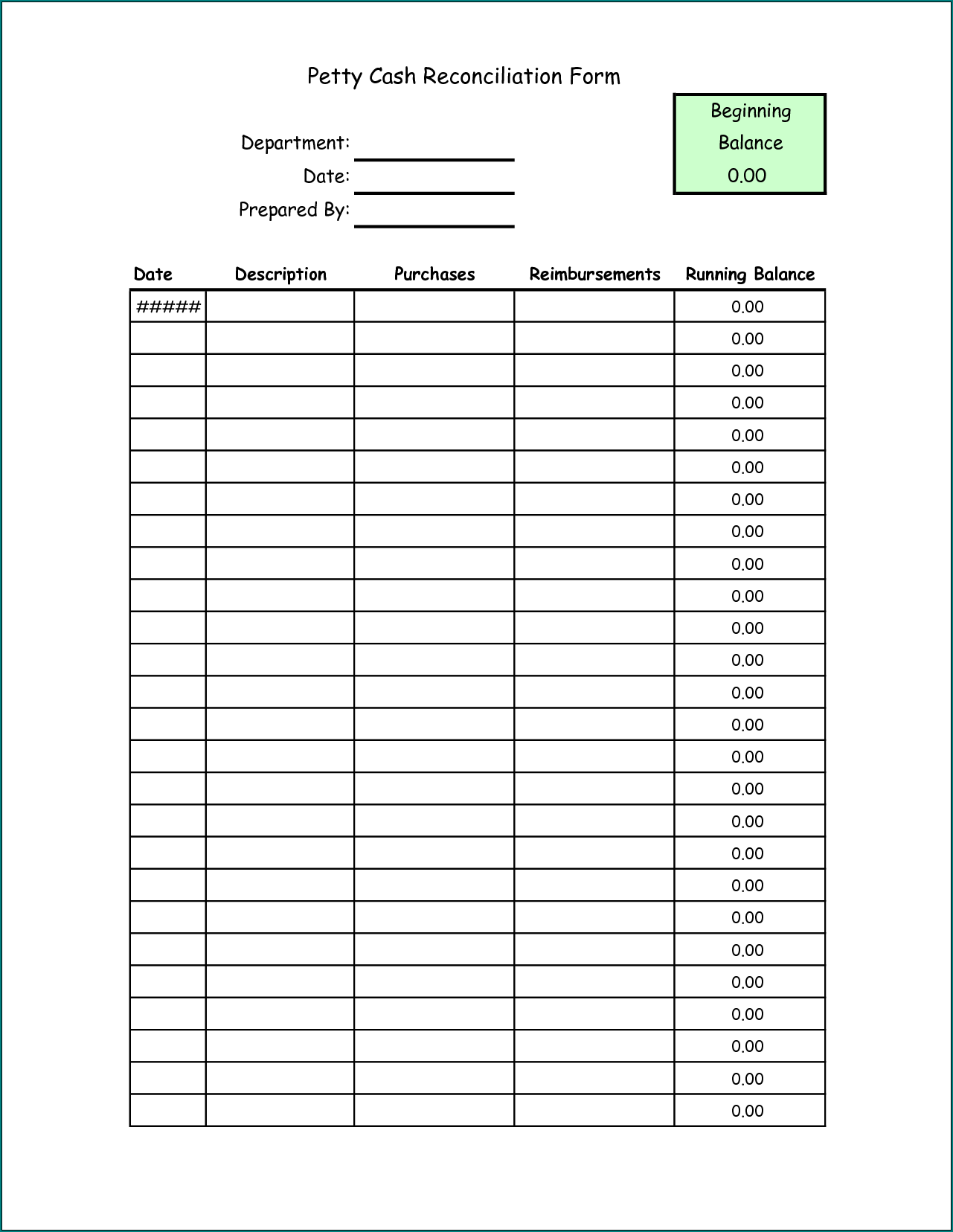

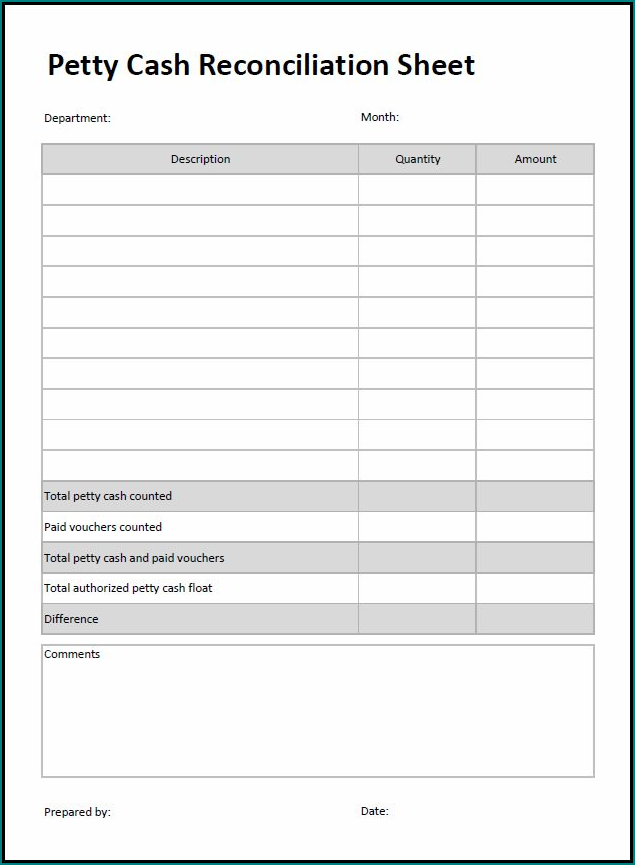

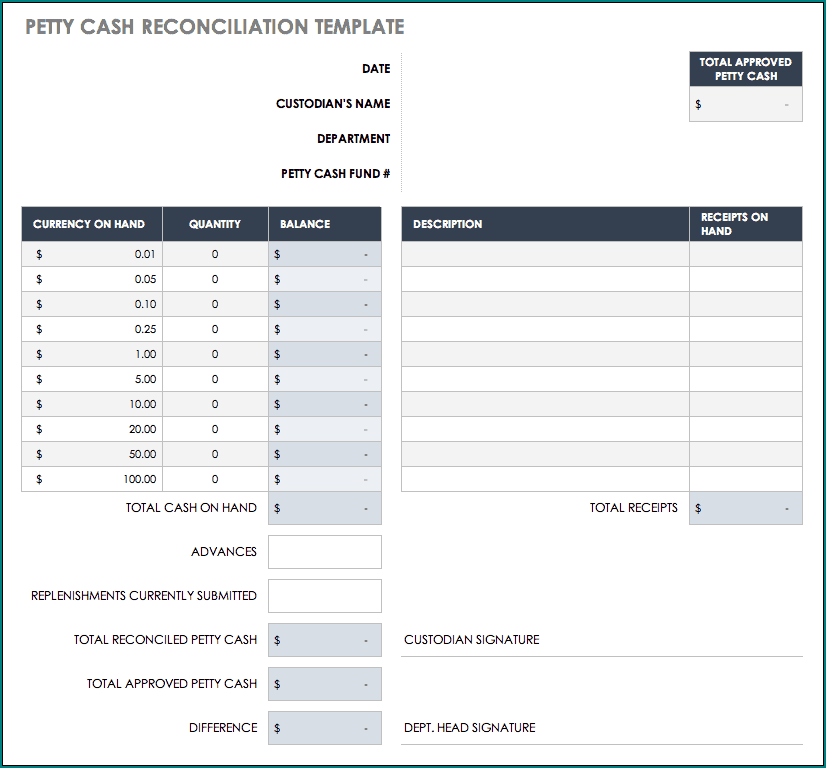

You can create a reconciliation form for your company or download templates that are available in the market. In both the case you can provide your inputs as per the company’s policy.

Step 3: Details of the Transaction

Mention the details of the transactions made by and calculate the total sum. Subtract it from the total balance then you will have the idea of the amount that has been withdrawn.

Step 4: Summarizing the Vouchers

Summarizing the voucher will provide you the amount that has been spent from the petty cash funds. The result should be zero. If the summarization result is positive then there is an overdose of cash and if the result is negative then there is a shortage of the fund.

Samples of Petty Cash Reconciliation Form :

Step 5: Scrutinize the Imbalance

Scrutinize the amount that has been stated and the actual amount that is there in the petty cash fund. If there is any imbalance then rectify it. Make sure there is no unexpected difference.

Petty Cash Reconciliation Form | Excel download