A profit and loss, P&L, or earnings report shows your business’s revenue, expenses, costs, and net over a selected period of your time . you’ll generate a press release for any period of time , but the foremost four-four time frames include monthly, quarterly, or annually.

Business owners can use P&L statements to work out whether or not they got to improve their bottom line by increasing revenue or cutting costs.

To make your profit and loss statement, you want to gather some information. you’ll need your business’s:

Total income

Cost of products sold (COGS)

Total expenses

How to create a profit and loss statement

there is four sections in P&L:

Income

Expenses

Cost of products sold

Net income

The above sections should be lines on your profit and loss statement.

When you create your statement, start together with your income/revenue. Then, work your way down and subtract expenses.

Income

Income, or revenue, includes your business’s total sales. It also includes money you receive from selling things like equipment or receiving a tax refund.

Income is that the first item you want to list on your P&L statement. It should be a positive number and include any money you earned from sales.

Cost of products sold

Your COGS is what proportion it costs to supply your goods or services. Your cost of products sold includes direct material and direct labor expenses. To calculate your COGS, add your beginning inventory and purchases during the accounting period together. Then, subtract your ending inventory from your total.

Subtract your cost of products sold from your revenue once you create your P&L statement to urge your gross profit margin .

Expenses

Business expenses are costs you incur during day-to-day business operations, like insurance, marketing costs, and equipment.

Your expenses likely include operating expenses (OPEX). Operating expenses include things like salaries, rent, and utilities. These expenses keep your business going, but don’t produce sales.

Subtract your expenses from your income to create your profit and loss statement.

Net income

Net income, or net income , is that the bottom line of your profit and loss statement. net is what’s left after you subtract all of your expenses from your income.

Hopefully, you’ll see a net income at rock bottom of your profit and loss statement. If you’ve got a net income , your business is earning quite it spends. If your expenses outweigh your revenue, you’ll have a net loss.

Other items on your profit and loss statement

In addition to the five main sections above, your business may additionally got to report other items on your P&L statement. counting on your industry, you would possibly got to include other items like:

Depreciation

Financial costs/gains

Extraordinary costs/gains

EBIT/EBITDA

Keep in mind that the things reported on a profit and loss statement vary from business to business.

Depreciation

When you buy certain items, like equipment or a vehicle, the asset loses its value (depreciates) over time. Depreciation are often a big number that impacts your business’ worth.

Depreciation is usually lumped along side COGS on your profit and loss statement.

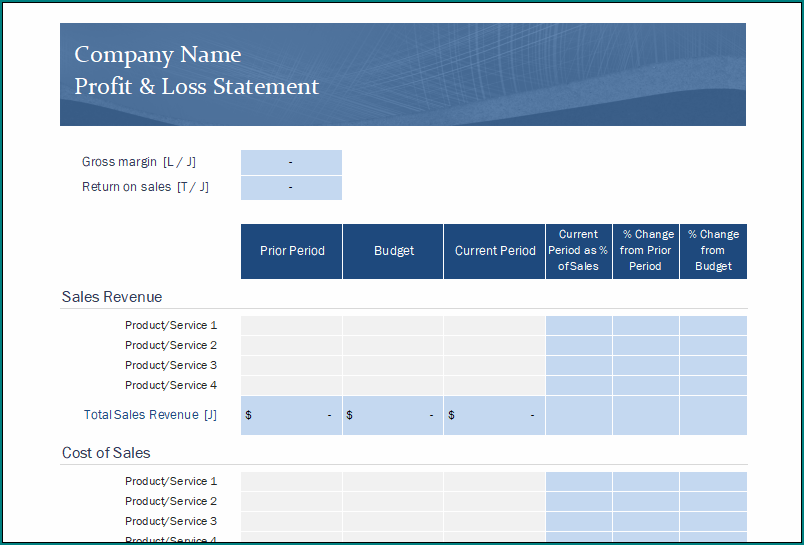

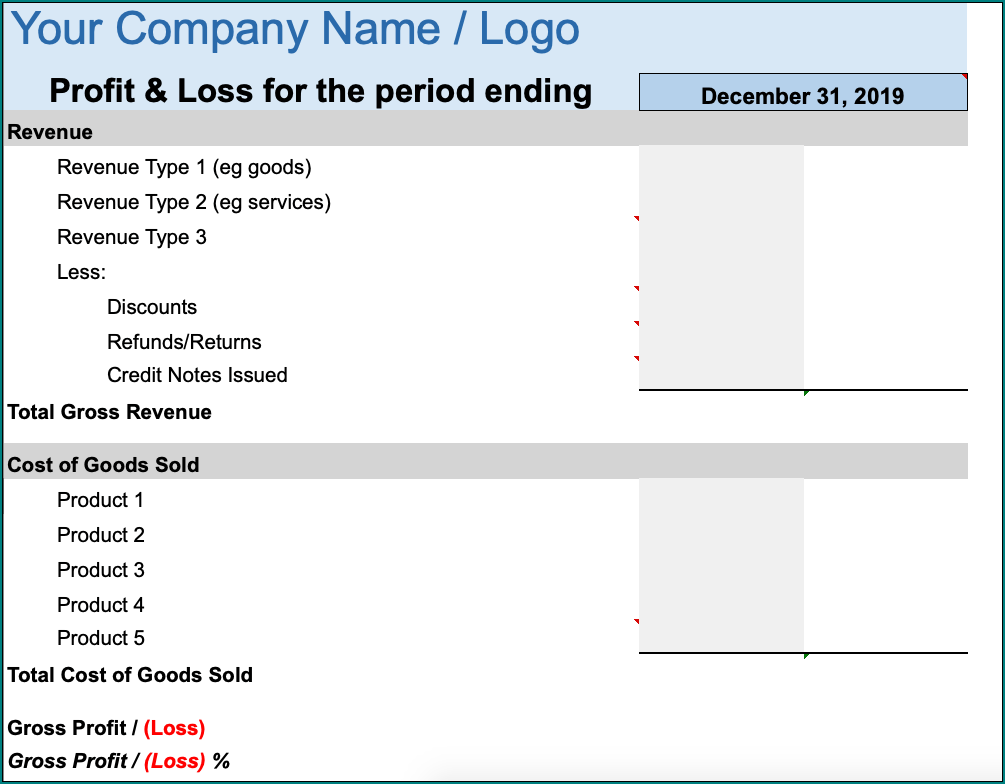

Samples of Profit And Loss Statement For Small Business :

Financial costs/gains

Financial costs and gains represent changes in your debts or investments. This line can either be positive or negative and shows you either have accrued interest in money you owe or have earned interest from your investments.

Extraordinary costs/gains

Extraordinary costs and gains generally ask one-time impacts on your business. for instance , say you sold an outsized , depreciated asset. That transaction is taken into account to be a unprecedented gain. Or, say you create an outsized , one-time purchase. that enormous purchase is a unprecedented cost.

EBIT/EBITDA

EBIT (Earnings Before Interest and Taxes) measures how profitable your business is over time. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) shows your company’s operating performance.

Profit And Loss Statement For Small Business | Excel download