A budget chart, also known as a budget graph or budget planner, is a visual representation of your financial plan. It helps you track your income, expenses, and savings over a specific time. A budget chart allows you to see where your money is coming from and where it is going, making it easier to make informed financial decisions and achieve your financial goals.

Why Should You Use a Budget Chart?

Creating and using a budget chart can have numerous benefits for your financial well-being. Here are some reasons why you should consider using a budget chart:

- Track your spending: A budget chart helps you keep tabs on your expenses and identify areas where you can cut back.

- Plan for the future: With a budget chart, you can allocate funds for savings, investments, and future goals.

- Stay organized: A budget chart provides a clear overview of your finances, making it easier to stay organized and avoid financial stress.

- Make informed decisions: By visualizing your income and expenses, a budget chart allows you to make informed decisions about your finances.

- Achieve financial goals: Whether you’re saving for a vacation, a new car, or retirement, a budget chart can help you stay on track and reach your financial goals.

How to Create a Budget Chart

Creating a budget chart doesn’t have to be complicated. Follow these steps to create your budget chart:

1. Determine Your Income

The first step in creating a budget chart is to determine your total income. This includes your salary, any side hustles, rental income, or any other sources of income you have. Add up all these sources to get your total monthly income.

2. Track Your Expenses

Next, track your expenses for a month. This should include all your fixed expenses like rent/mortgage, utilities, and insurance, as well as variable expenses like groceries, entertainment, and dining out. Make sure to track every expense to get an accurate picture of your spending habits.

3. Categorize Your Expenses

Once you have tracked your expenses, categorize them into different categories such as housing, transportation, food, entertainment, and savings. This will help you identify areas where you can cut back and allocate funds accordingly.

4. Set Financial Goals

Now that you have an idea of your income and expenses, it’s time to set financial goals. Whether it’s saving for a down payment on a house or paying off debt, setting specific goals will help you stay motivated and focused.

5. Allocate Funds

Based on your income, expenses, and financial goals, allocate funds to each category in your budget chart. Be realistic and prioritize your needs over wants. If you find that your expenses exceed your income, look for areas where you can cut back and make adjustments.

6. Review and Adjust

Review your budget chart regularly, ideally every month, to track your progress and make adjustments as needed. Life circumstances and financial situations can change, so it’s important to regularly review and update your budget chart.

7. Use Budgeting Apps or Templates

If you prefer a more automated approach, consider using budgeting apps or templates. There are plenty of free and paid options available that can simplify the process and provide additional features like expense tracking, goal setting, and financial insights.

8. Stick to Your Budget

The most important step in creating a budget chart is to stick to it. It may require some discipline and adjustments along the way, but staying committed to your budget will help you achieve your financial goals in the long run.

Benefits of Using a Budget Chart

Using a budget chart can have a positive impact on your financial well-being. Here are some benefits of incorporating a budget chart into your financial planning:

- Improved financial management: A budget chart gives you a clear understanding of your financial situation, allowing you to manage your money more effectively.

- Reduced stress: Knowing where your money is going and having a plan in place can help reduce financial stress and anxiety.

- Increased savings: By tracking your expenses and setting savings goals, you can increase your savings and build a financial cushion.

- Debt reduction: A budget chart helps you identify areas where you can cut back and allocate more funds toward paying off debt.

- Financial independence: By taking control of your finances and making informed decisions, you can work towards achieving financial independence.

Best Practices for Creating a Budget Chart

To make the most of your budget chart, here are some best practices to keep in mind:

- Be realistic: When allocating funds, be realistic about your income and expenses. It’s better to underestimate your income and overestimate your expenses to avoid any surprises.

- Track your expenses diligently: Make sure to track every expense, no matter how small. This will give you a comprehensive view of your spending habits.

- Review and adjust regularly: Life circumstances and financial situations can change, so it’s important to regularly review and adjust your budget chart as needed.

- Involve your family or partner: If you’re sharing finances with your family or partner, involve them in the budgeting process. It’s important to have open and honest communication about financial goals and priorities.

- Stay motivated: Budgeting can sometimes be challenging, but staying motivated is key. Celebrate small milestones and remind yourself of the long-term benefits of sticking to your budget.

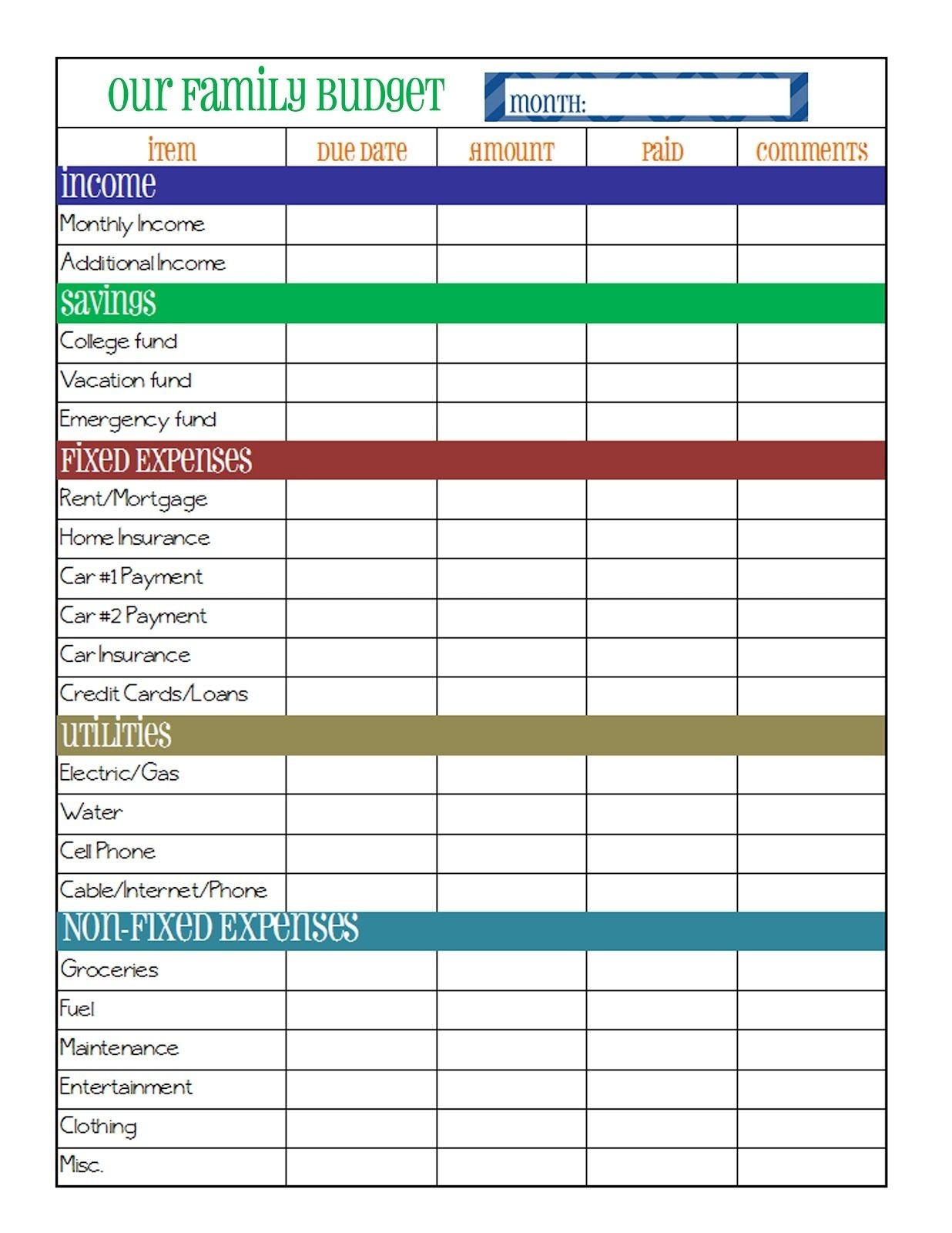

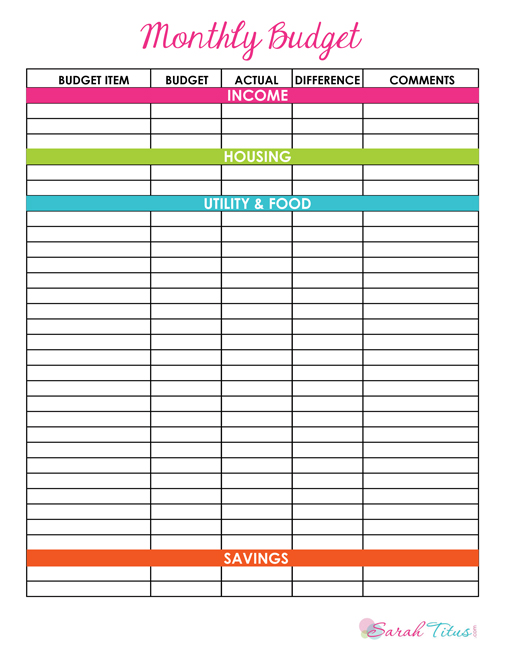

Examples of Budget Charts

Here are a few examples of budget charts to give you an idea of how they can be structured:

1. Monthly Budget Chart

A monthly budget chart breaks down your income and expenses every month. It allows you to track your spending and make adjustments as needed throughout the month.

2. Yearly Budget Chart

A yearly budget chart provides a more comprehensive overview of your finances. It helps you plan for long-term goals and identify any seasonal variations in your expenses.

3. Debt Payoff Budget Chart

A debt payoff budget chart focuses on paying off debt. It helps you allocate extra funds towards debt repayment and track your progress as you work towards becoming debt-free.

4. Savings Goal Budget Chart

A savings goal budget chart is designed to help you save for a specific goal, such as a vacation or a down payment on a house. It allows you to allocate funds towards your savings goal and track your progress along the way.

5. Retirement Budget Chart

A retirement budget chart is tailored towards saving for retirement. It helps you allocate funds towards retirement savings and ensures you are on track to meet your retirement goals.

6. Emergency Fund Budget Chart

An emergency fund budget chart focuses on building an emergency fund. It helps you allocate funds towards your emergency fund and ensures you have a financial safety net in case of unexpected expenses.

7. College Fund Budget Chart

A college fund budget chart is designed to help you save for your child’s education. It allows you to allocate funds towards a college savings account and track your progress as you work towards funding your education.

Conclusion

A budget chart is a powerful tool that can help you take control of your finances and achieve your financial goals. By creating a budget chart, tracking your income and expenses, and making informed decisions, you can work towards financial stability and peace of mind. Remember to stay committed, review and adjust regularly, and celebrate your progress along the way. Start creating your budget chart today and take the first step towards a brighter financial future.

Budget Chart Template Excel – Download